Table of Contents

Last week we witnessed the fall of one of the largest centralized crypto exchanges in the world. Ever since then I’ve spent days keeping up with the FTX collapse, Binance pulling out of the acquisition, SBF running off to Argentina through hundreds of tweets and 40+ hours of Twitter spaces.

Which is why I’ve put the whole event together piece by piece so that you can catch up and also understand the FTX collapse a little more deeply.

What is FTX?

FTX is a centralized cryptocurrency exchange (CEX) founded in 2019 by Sam Bankman-Fried (SBF). Since launching, FTX had issued its own token (FTT) and had made its way to the top as world’s second-largest centralized crypto exchange.

The backstory

- In 2019, Binance became an early investor and strategic partner for FTX.

- CZ (CEO of Binance) became SBF’s (CEO of FTX) big brother. Binance helped FTX. FTX helped Binance. The bromance peaked.

- Then things changed. In 2021, FTX bought out any remaining Binance shares in the company.

- Binance received ~2.1 Billion in the exit. A big chunk of this was paid out in FTT – FTX’s token (this is important).

- Bankman-Fried also found the crypto trading firm, Alameda Research (important too).

How the FTX Collapse happened

Key points of the drama 👇🏼

CoinDesk’s report on Alameda on November 2nd revealed that Alameda held a troubled balance sheet. According to the report, its largest assets were billions of dollars worth of FTT. So basically, a crypto trading firm, founded by SBF, was holding way too much FTT and keeping its price inflated. Let’s remember SBF also founded FTX – which the FTT token belongs to.

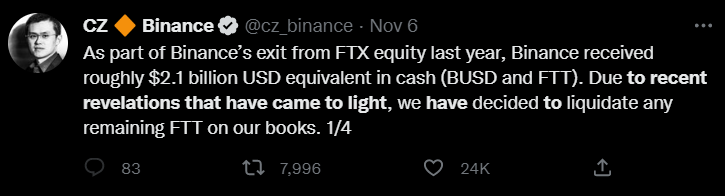

Changpeng Zhao (CZ) tweeted his plan to sell Binance’s holdings of FTT on November 6th because of “recent revelations that have came to light”. Further, he compared the FTX collapse to the crash of Terra LUNA in May this year, which crashed the crypto market and bankrupted many.

Zhao’s announcement led to the market tanking rapidly. FTT’s value crashed from 25$ to 2$ overnight. The market FUD and the Fear Index were peaking among crypto users. The public started suspecting that FTX didn’t have the liquidity needed to back transactions to stay afloat (which was the case IRL).

An all-time low in 2 years. This time last year Bitcoin had touched an all-time high of $69,000 dollars. Last week it touched two years’ an all-time low of $16,000. SBF said in a tweet that they saw $5 billion in withdrawals from November 6th.

CZ struck a deal to acquire FTX. Binance signed a non-binding letter of intent on November 8th expressing the intention of acquiring the failing exchange to prevent the market crash. This sent some hope across the market and it even recovered (for a tiny while).

Binance’s withdrawal from the deal. A day after signing the letter of intent, CZ posted in a tweet that after completing “corporate due diligence” they won’t be acquiring FTX. The reason for backing out according to Zhao was the news reports of “mishandled customer funds” and “alleged U.S. agency investigations”.

Caroline Ellison, the CEO of Alameda tweeted in an attempt to save FTX, said the report by CoinDesk wasn’t fully inclusive of all the data and that they had $10 billion assets that weren’t reflected.

In a final attempt to rescue FTX offered Zhao to buy all their FTX tokens at $22 a piece. This was to keep the funds and stop them from reaching the open market. Zhao, however, declined this offer and continued selling FTT in the open market.

FTX and Alameda filed for voluntary Chapter 11 bankruptcy. Chapter 11 bankruptcy allows businesses to restructure their debt and continue operations. Unlike Chapter 7 bankruptcy, where assets are liquidated.

4 days later a hack happened at FTX. Friday evening FTX reported that they had been hacked and $600 million were stolen in the hack. There is a running conspiracy that this hack was an inside job. SBF had also instructed his CTO to create a backdoor to remove funds without the knowledge of investors and users.

Financial Times published FTX’s balance sheet on November 10th. SBF and Caroline’s throne of lies effectively burned to the ground on November 10th as a report by Financial Times showed that FTX held only $900 million in assets against $8-9 billion in liabilities! And this is before the hack took place.

Is SBF on the run now?

It has been reported that SBF is in the Bahamas and under “police supervision” with his father. Word on the street is that SAM and FTX Executives are trying to run off to Dubai.

Dubai is one of the few countries that does not have an extradition treaty with the USA. An investigation has been launched to dig into this rubble. Reportedly about 60 people from all around the world flew to the Bahamas to find SBF!

The aftermath

A number of companies that had their money invested in FTX or had held FTT have suffered. Tokens like Solana $SOL crashed beyond 30% in a day.

Let’s look at the effect of FTX on some massive companies in the space.

Binance

CZ told on a Twitter Space on Monday that Binance previously held $580 million worth of FTT of which “we only sold quite a small portion, we still hold a large bag”

BlockFi

Cryptocurrency lender, Blockfi said it had significant exposure to FTX and withdrawals from its platform continue to be paused.

“We do have significant exposure to FTX and associated corporate entities that encompass obligations owed to us by Alameda, assets held at FTX.com, and undrawn amounts from our credit line with FTX.US,” BlockFi said.

Celsius Network

Bankrupt crypto lender Celsius Network said in a tweet that they had 3.5 million Serum Tokens (SRM) on FTX as well as around $13 million in loans to FTX-linked trading company Alameda Research.

Coinbase

Coinbase Global reported that it had $15 million worth of deposits on FTX. It also said that it had no exposure to FTT and no exposure to Alameda Research.

Crypto.com

The Singapore-based crypto exchange said that it had moved about $1 billion to FTX over the course of a year. Most of it was recovered and the exposure at the time of FTX’s collapse is less than $10 million.

Solana

Solana crashed by 52% after the FTX and Alameda collapse since Solana was heavily backed by Alameda. Investors feared Alameda selling off all their SOL tokens in the open market and making a run. Solana co-founder Anatoly Yakovenko tweeted that their development company Solana Labs didn’t hold any assets on FTX and had enough financial runway for around 30 months.

Companies went bankrupt. People lost 5, 6, 7 figures worth of money in the FTT crash. The crypto winter just got a hell lot colder. The global market cap for cryptocurrency dropped from over $1 trillion to $900 billion after the crash.

CZ from Binance had a message for every builder in Web3 “as a technology, blockchain tech and the industry is not going away” so keep building. Web3 was here before this crash and will stay stronger after every bad player is washed off.

Wagmi, friends. Don’t lose hope, keep buidling.

Know web3 basics?

Start building your blockchain portfolio with these projects 👇🏼

⚡️ Create your own Ethereum token in just 30 mins