Table of Contents

A flash loan is a type of short-term, high-risk loan that allows borrowers to access large amounts of capital quickly, without requiring collateral or credit checks.

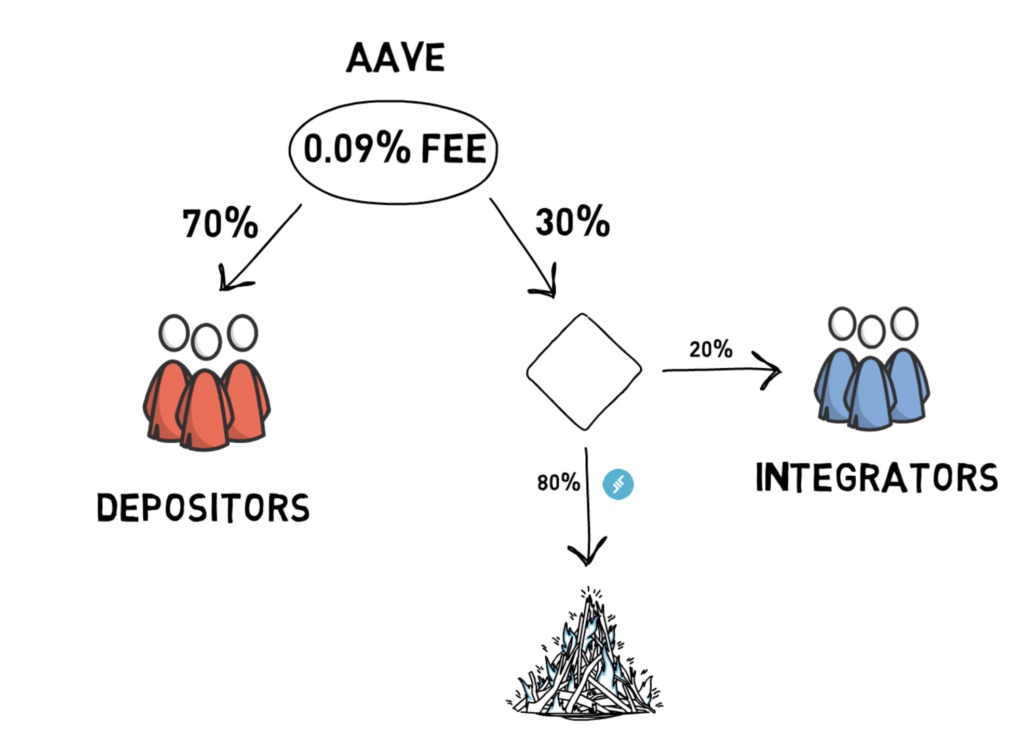

Flash loans are typically offered by decentralized finance (DeFi) platforms, such as Aave, which is a popular lending and borrowing platform built on the Ethereum blockchain.

On Aave, a flash loan is created through the use of smart contracts, which are self-executing contracts that automatically enforce the terms of the loan agreement.

So, when a borrower wants to take out a flash loan, they can do so by submitting a request to the Aave platform, specifying the amount of the loan and the terms of the loan agreement. The Aave platform will then automatically create a smart contract that outlines the terms of the loan, including the interest rate and the repayment schedule.

Once the loan contract is created, the borrower can access the loan funds immediately. However, the loan must be repaid in full within a certain timeframe, typically within a few hours or less. If the borrower is unable to repay the loan within the specified time frame, the loan will automatically default, and the borrower will lose any collateral they have put up as security for the loan.

Flash loans on Aave are highly risky but can offer borrowers access to large amounts of capital quickly and without collateral. They are often used for complex financial transactions, such as arbitrage opportunities or liquidity provision.

The risks and rewards of using a flash loan on Aave

🎉 Rewards

- Flash loans can offer borrowers access to large amounts of capital quickly and without the need for collateral. This can be particularly useful for borrowers who need capital quickly to take advantage of arbitrage opportunities or to provide liquidity to a market.

- The use of smart contracts on Aave can help to automate the loan process and ensure that the terms of the loan are enforced transparently and securely. This can help to reduce the risk of fraud or other disputes between borrowers and lenders.

- Flash loans on Aave can be useful for borrowers who may not have sufficient collateral or creditworthiness to secure a traditional loan. This can provide access to capital for borrowers who may otherwise be unable to borrow.

❌ Risks

- Flash loans are considered to be highly risky for both borrowers and lenders. Because they are not backed by collateral, a default on the loan can result in significant losses for both parties.

- Flash loans are subject to fluctuations in the value of the underlying collateral, which can make them volatile and unpredictable. This can increase the risk of default and make it difficult for borrowers to accurately predict the cost of borrowing.

- The short repayment period of flash loans on Aave can make them challenging to repay, particularly if the borrower is unable to take advantage of the capital quickly or if the market conditions change unexpectedly.

- The use of smart contracts on Aave can also introduce additional risks, such as the potential for errors or bugs in the contract code that could lead to unexpected outcomes or disputes.

Step-by-step guide to creating a flash loan on Aave

Here’s how to do it:

- Set up a compatible wallet like MetaMask that supports the Ethereum blockchain and is compatible with Aave. This will typically involve downloading a wallet app and creating a new wallet, or importing an existing wallet.

- Connect your wallet to the Aave platform by entering your wallet address and other details.

- Deposit funds into your wallet as collateral for the loan. This will typically be Ether (ETH) or a stablecoin such as USDC or DAI.

- Submit a request for a flash loan on Aave, specifying the amount and terms of the loan. The Aave platform will automatically create a smart contract for the loan.

- The loan funds will be immediately available in your wallet. Use the funds for your intended purpose.

- Repay the loan in full within the specified time frame. This can typically be done by sending the funds from your wallet to the Aave platform.

- The smart contract will be closed and the collateral will be released back to your wallet.

It is important to carefully consider the risks and potential rewards of taking out a flash loan on Aave before proceeding with a loan request. Flash loans are highly risky and can result in significant losses if the borrower is unable to repay the loan within the specified time frame. You can find the steps to get a flash loan on Aave in their documents also.

Real-world examples of successful flash loan transactions on Aave

May 2021: a user on the Aave platform took out a flash loan of 1,000 ETH (worth approximately $3.5 million at the time) to take advantage of an arbitrage opportunity on the Uniswap decentralized exchange. The user was able to quickly buy and sell a large amount of a cryptocurrency, capturing the price difference and earning a profit of over $100,000 within a few minutes.

June 2021: a group of users on the Aave platform coordinated a flash loan transaction to provide liquidity to a new DeFi protocol that was launching on Ethereum. The users took out a flash loan of over 50,000 ETH (worth approximately $160 million at the time) and used the funds to buy the new protocol’s native token, providing much-needed liquidity and helping to launch the protocol successfully.

July 2021: a user on the Aave platform took out a flash loan of 100 ETH (worth approximately $70,000 at the time) to fund a yield farming strategy on the Curve decentralized exchange. The user deposited the loan funds into a liquidity pool on Curve and earned a significant amount of yield in a short period of time, before repaying the loan and making a profit.

These examples show that flash loans on Aave can be used for a wide range of purposes, including arbitrage opportunities, liquidity provision, and yield farming strategies.

With that all being said, be wise with flash loans as they come with massive risk and can result in significant losses especially if borrowers are unable to repay loans within a specified time frame.

Hope you found this helpful!