Table of Contents

What is Layer 1 Blockchain?

Layer 1 (L1) is a fancy name given to the core workings and base infrastructure of an on-chain blockchain such as Bitcoin. Layer 1, also known as the ‘implementation layer’, refers to the core architecture of a blockchain network. Its first iteration was created by Satoshi Nakamoto in 2008 and named Bitcoin.

L1 coins and blockchains are autonomous and self-sufficient which is why they don’t need a separate network.

But then who needs a separate network? We talk about that in Layer 2 (L2) blockchains. For now, let’s stick to L1 or independent blockchains.

But why L1 Blockchain? 🤔

Lovely question! The blockchain system works in layers because it is essentially and inherently a complex system. No wonder it is called Web 3.0 meaning it is more holistic, complex, and exploratory than Web 2.0. Now, for something as complicated as blockchains, layers come in handy.

By adding layers to a blockchain, developers, innovators, and programmers can improve a blockchain’s functionality and enhance its features without ever compromising on the quality, security, and decentralization of a blockchain.

L1 blockchains have always been there. In fact, the term itself is as old as the early days of cryptocurrency. The term gained traction and popularity when in 2014, Ethereum introduced the concept of multiple layers functioning for the main blockchain, allowing it to scale and expand in less time.

After 2014, Layer 1 became a signifier and a differentiator for main blockchains as their extensions like secondary and tertiary layers which include layer 2 blockchain networks, plasma chains, etc. came forth.

Layering in cryptocurrency also helps with the modular development of a currency. Modular development refers to a modular architecture that allows for the development of individual components of something (blockchain, in this case). Thus, using layers, different areas of a blockchain/coin can be worked on by different developers without affecting the other layers.

In simpler terms, L1 is referred to the core and foundational protocol of mainstream blockchains and whatever is an extension of L1 blockchains falls under secondary or tertiary layers which are layer 2 and layer 3, respectively.

On a conceptual level, Layer 1 forms the foundational base of any blockchain network. It defines a set of rules for operations like transaction throughput, block time, and a consensus algorithm that governs the entire network.

Features of Layer-1 Blockchain

Now that you know how layer 1 is the name of the underlying working mechanism of mainstream blockchains, here is a list of some of their features:

Fully Decentralised

Layer 1 is not dependent on a third party. It is essentially decentralized, adding more to its self-sufficient and self-governing nature. Decentralized in blockchain refers to a network that is not dependent on an all-encompassing central authority. L1 blockchains, thus, are their own controlling authority and are also accountable for their security and transparency.

Consensus mechanisms

A blockchain is essentially a network of different blocks managed by different servers and nodes. This network is sustained using a consensus mechanism and there are two main consensus mechanisms – Proof-of-Work (PoW) and Proof-of-Stake (PoS). Layer 1 blockchains can either be following PoW like Bitcoin or PoS like Ethereum.

Immutable ledger

In cryptocurrencies, there is an important feature called a ledger. An old concept that has been used by centralized systems like banks since time immemorial, a ledger in cryptocurrencies is used to record transaction data. Layer 1 cryptocurrencies’ unique selling point is that they are immutable, meaning once a transaction has been processed and registered in the ledger, it can’t be changed.

Popular read 👉 full 2024 blockchain guide

Limits of L1 Blockchain

Now, while there are amazing features to Layer 1 coins, there are some drawbacks and some limitations as well. Guess, you can’t be the jack of all trades. These limitations include:

Scalability – A Challenge

Scalability is one of the major issues in Layer 1 blockchains. Take Bitcoin for example. The blockchain supports a PoW consensus system and can only approve 3-7 transactions per second.

That’s awfully low, isn’t it? And this number is not fixed. It varies depending on the size of the transaction. Now, add high transaction costs and low transaction verification speed. The blockchain ends up becoming a big white elephant.

However, to combat this problem, we have Lightning Network – an L2 subsidiary of bitcoin – to help process transactions faster and at low costs.

Layer 1 is not ready for mass adoption.

Vitalik Buterin of Ethereum

The scalability problem, specifically in the Layer 1 Ethereum Blockchain, is expected to be solved by the current consensus mechanism – PoS.

Some blockchains like Algroand, Solana, and Avalanche are performing well and have been quite successful in solving the scalability problem.

Flexibility – an illusive dream

Flexibility is difficult in Layer 1 blockchains. Why? Because making decisions like increasing flexibility or functionality in a full-fledged and developed blockchain is tricky. This is because of a concept called hard fork which, in blockchains, refers to a software upgrade that almost always leads to a split in the main blockchain. A split leads to the creation of two blockchains out of one with both of them following different protocols and different rules and entailing different features.

Hacks and attacks

Another super challenge in Layer 1 blockchains is that they are prone to get attacked. Layer 1 blockchains are not just some coin or token manufacturing systems; they are huge networks within themselves. And security in such widely overarching networks can be an issue.

Attacks like the 51% where an entity or a group ends up controlling the blockchain through its hashing power can disrupt the network.

Moreover, when L1 networks get an overwhelming amount of transactions, they can face a big challenge called Denial-of-Service (DoS) attacks. Not being able to process further transactions is not just an attack but also a credibility issue and a big hurdle in the face of user experience.

Websites to find under-valued Layer 1 crypto projects

One of the most asked questions is how to find new Layer 1 crypto projects that are under-valued and can also offer good returns on investment.

Now, as of yet, no hard and fast rule could help measure and decide which Layer 1 blockchain is good for future investments. But here are some resources/websites that you can use.

Token Terminal

A good website to fetch data regarding L1 blockchains is Token Terminal. It has, if not the most accurate, a substantial amount of data in the form of token performance and financial metrics that can give you a good price-to-earnings ratio if you happen to invest in a Layer 1 coin.

Token Metrics

Yet another website is called Token Metrics. Latest and more advanced in its workings, Token Metrics uses AI and machine learning to deduce, project, and predict the trajectory of various projects including L1 coins.

CoinGecko

Yet another website that can come in handy in deciding, with tangible data, facts, and figures, which Layer 1 crypto projects to invest in is called CoinGecko. It uses aggregate data to generate new and useful insights for crypto users and potential investors.

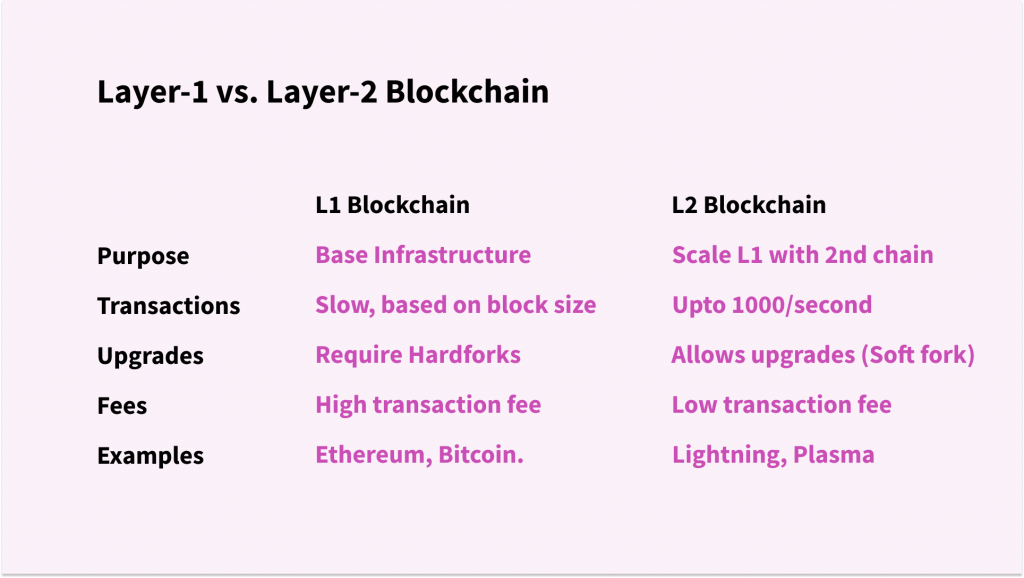

Differences between Layer 1 and Layer 2

Just in case you are still not clear about the differences between L1 and L2, here is a table detailing the main differences between the functionalities, purposes, and features of both layers.

| Layer 1 | Layer 2 | |

| Purpose | The successful creation of an immutable, secure, and decentralized ledger | Assisting the L1 blockchain in verifying more transactions in less time and fewer costs |

| Security | Based and dependent on different consensus mechanisms | Entails additional security measures all while leveraging and enhancing those of L1 |

| Number of transactions per second | Limited to single digits and majorly based on block size | Up to a 1000 transactions in a second |

| Upgrades and changes within the network | Requires hard forks and splitting of a blockchain | Existing protocols allow for timely upgrades using soft forks |

| Transaction fees | High transactions fees | Low transaction fee |

| Optimality | Low optimality | High optimality |

| Examples | Ethereum, Bitcoin, etc. | Lightning Network, Plasma, etc. |

List of 35 Layer 1 Blockchain ⛓

1. Bitcoin

Bitcoin is the original and most well-known cryptocurrency, created by the pseudonymous Satoshi Nakamoto in 2009. It operates on a decentralized peer-to-peer network, enabling secure and transparent transactions without the need for intermediaries. Bitcoin’s primary function is as a store of value and digital currency, often referred to as “digital gold.”

2. Solana

Solana is a high-performance blockchain platform designed for decentralized applications (dApps) and crypto-currencies. It aims to provide scalable and user-friendly solutions with its Proof of History (PoH) consensus combined with Proof of Stake (PoS), enabling fast transaction speeds and low costs, making it a popular choice for DeFi projects and NFT marketplaces.

3. Ethereum

Ethereum is a decentralized blockchain platform that enables smart contracts and decentralized applications (dApps) to be built and run without any downtime, fraud, or interference from a third party. Launched in 2015 by Vitalik Buterin, Ethereum has its native cryptocurrency, Ether (ETH), and is known for its versatility and robust developer community.

4. Avalanche

Avalanche is a decentralized, open-source platform for launching decentralized finance applications and enterprise blockchain deployments in one interoperable, highly scalable ecosystem. It uses a novel consensus protocol, Avalanche consensus, which aims to provide robust security, fast finality, and high throughput.

5. NEAR Protocol

NEAR Protocol is a developer-friendly, Proof of Stake (PoS) blockchain that aims to provide the ideal environment for dApps with a focus on usability and scalability. Its unique sharding technology, Nightshade, enables efficient transaction processing and enhances the network’s overall scalability and speed.

6. Zcash

Zcash is a privacy-focused cryptocurrency that leverages advanced cryptographic techniques to ensure transactions are secure and private. Launched in 2016, Zcash offers two types of addresses: transparent (t-addresses) and shielded (z-addresses), enabling users to choose between transparency and privacy.

7. Algorand

Algorand is a scalable, secure, and decentralized digital currency and transactions platform. Founded by MIT professor Silvio Micali, Algorand uses a pure Proof of Stake (PPoS) consensus mechanism to ensure full participation, protection, and speed within a truly decentralized network.

8. BNB Chain

BNB Chain, originally known as Binance Smart Chain (BSC), is a blockchain platform developed by Binance, one of the world’s largest cryptocurrency exchanges. It supports smart contracts and is compatible with the Ethereum Virtual Machine (EVM), allowing developers to create dApps and DeFi projects with lower transaction fees and faster processing times.

9. Astar

Astar Network is a decentralized application hub on the Polkadot network that supports building dApps with EVM and WASM smart contracts. Its multi-chain approach aims to bridge the gap between different blockchain ecosystems, providing developers with the tools to create scalable and interoperable applications.

10. Cronos

Cronos is a blockchain platform developed by Crypto.com, designed to support the creator economy with decentralized finance (DeFi) and decentralized applications (dApps). Built on the Cosmos SDK and compatible with the Ethereum Virtual Machine (EVM), Cronos aims to deliver fast and low-cost transactions.

11. Kadena

Kadena is a scalable, high-throughput Proof of Work (PoW) blockchain platform designed to handle industrial-level applications and services. Its unique architecture, Chainweb, combines multiple parallel chains to enhance throughput and efficiency without compromising security.

12. Cosmos (ATOM)

Cosmos is a decentralized network of independent blockchains, each powered by the Tendermint consensus algorithm. Its primary goal is to enable interoperability between different blockchains, creating an “Internet of Blockchains” where information and assets can flow freely across previously isolated networks.

13. Wax

WAX is a blockchain platform specifically designed for the trading of virtual items, such as collectibles and in-game assets. Launched by the founders of OPSkins, WAX uses a Delegated Proof of Stake (DPoS) consensus mechanism to offer high transaction speeds and low fees.

14. Polkadot (DOT)

Polkadot is a multi-chain blockchain platform designed to enable different blockchains to interoperate and share information securely. Created by Dr. Gavin Wood, one of the co-founders of Ethereum, Polkadot uses a unique relay chain and parachain architecture to achieve scalability, security, and interoperability.

15. Cardano (ADA)

Cardano is a third-generation blockchain platform that aims to deliver more advanced features than any protocol previously developed. Founded by Charles Hoskinson, one of the co-founders of Ethereum, Cardano uses a unique Proof of Stake consensus mechanism called Ouroboros, focusing on sustainability, scalability, and interoperability.

16. Tezos (XTZ)

Tezos is a self-amending blockchain platform designed for creating smart contracts and dApps. It uses an on-chain governance model to enable protocol upgrades without hard forks, aiming for long-term stability and community-driven development. Tezos also employs a unique Liquid Proof of Stake (LPoS) consensus mechanism.

17. Tron (TRX)

Tron is a blockchain platform focused on building a decentralized internet and supporting decentralized applications (dApps). Founded by Justin Sun, Tron aims to provide a scalable and efficient environment for developers, with a focus on content sharing and entertainment.

18. Aptos

Aptos is a layer-1 blockchain that emphasizes safety, scalability, and upgradeability. It uses a unique parallel execution engine and aims to deliver high throughput and low latency, making it suitable for a wide range of decentralized applications (dApps).

19. Flare Network

Flare Network is a scalable, decentralized smart contract platform that integrates with various blockchains, including those that do not natively support smart contracts. It uses a consensus mechanism called Avalanche on Flare (AoF), aiming to provide interoperability and bring smart contract functionality to different blockchain ecosystems.

20. Shardeum

Shardeum is a blockchain platform designed to achieve scalability through sharding. By dividing the network into smaller, more manageable pieces, Shardeum aims to provide high throughput and low latency, making it suitable for a wide range of applications and use cases.

21. Sui

Sui is a decentralized, permissionless blockchain designed to provide high throughput, low latency, and robust security for a wide range of decentralized applications. It leverages a novel consensus mechanism and state-of-the-art cryptographic techniques to achieve these goals.

22. XDC Network

XDC Network is a hybrid blockchain platform designed for global trade and finance. It combines the advantages of public and private blockchains, enabling secure, fast, and scalable transactions while maintaining a high level of transparency and interoperability.

23. Core

Core is a blockchain platform focused on providing scalable and secure solutions for decentralized applications (dApps). It uses a unique consensus mechanism to achieve high throughput and low latency, making it suitable for a wide range of use cases.

24. Decimal

Decimal is a blockchain platform designed to provide a scalable and secure environment for decentralized applications and digital assets. It focuses on interoperability and ease of use, enabling developers to create and deploy applications with minimal friction.

25. Innovator Chain

Innovator Chain is a blockchain platform focused on fostering innovation and supporting the development of decentralized applications. It aims to provide a scalable, secure, and user-friendly environment for developers and users alike.

26. Alephium

Alephium is a high-performance blockchain platform designed for scalability and security. It uses a unique sharding mechanism and consensus protocol to achieve high throughput and low latency, making it suitable for a wide range of applications and use cases.

27. Circular Protocol

Circular Protocol is a blockchain platform designed to support the development of decentralized applications and digital assets. It focuses on scalability, security, and interoperability, enabling developers to create and deploy applications with minimal friction.

28. Hela

Hela is a blockchain platform designed to provide scalable and secure solutions for decentralized applications and digital assets. It uses a unique consensus mechanism and state-of-the-art cryptographic techniques to achieve high throughput and low latency.

29. START

START is a blockchain platform focused on providing scalable and secure solutions for decentralized applications and digital assets. It uses a unique consensus mechanism to achieve high throughput and low latency, making it suitable for a wide range of use cases.

30. WOW Earn Chain

WOW Earn Chain is a blockchain platform designed to support the development of decentralized applications and digital assets. It focuses on scalability, security, and user-friendliness, enabling developers to create and deploy applications with minimal friction.

31. 5ire

5ire is a blockchain platform designed to achieve scalability and sustainability through innovative consensus mechanisms and energy-efficient protocols. It aims to provide a high-performance environment for decentralized applications and digital assets.

32. Injective Protocol

Injective Protocol is a decentralized exchange (DEX) protocol built on top of the Cosmos SDK. It aims to provide a fully decentralized trading experience with high throughput, low latency, and robust security, enabling users to trade a wide range of assets seamlessly.

33. XPLA

XPLA is a blockchain platform focused on providing scalable and secure solutions for decentralized applications and digital assets. It uses a unique consensus mechanism and state-of-the-art cryptographic techniques to achieve high throughput and low latency.

34. EOS

EOS is a blockchain platform designed for the development and hosting of decentralized applications (dApps). It uses a Delegated Proof of Stake (DPoS) consensus mechanism to achieve high throughput, low latency, and robust security, making it suitable for a wide range of use cases.

35. Fantom

Fantom is a high-performance, scalable, and secure blockchain platform designed for decentralized applications and digital assets. It uses a unique consensus mechanism called Lachesis to achieve high throughput and low latency,

FAQs

What is Layer 1 Blockchain?

A L1 Blockchain or Layer-1 Blockchain is the foundational blockchain architecture at the base level. It is an autonomous chain that directly executes, confirms, and records all the smart contract transactions happening across the blockchain ecosystem. It also provides the essential decentralised infrastructure for Dapps and cryptocurrency for computer, storage, and verification.

What is Layer 1 and Layer 2 in Blockchian? (L1 vs. L2 Blockchain)

While the Layer 1 is a base blockchain protocol (like Ethereum or Bitcoin), Layer 2 is a 2nd chain (protocol) build to integrate with the base chain. The purpose of L2 Chain is to execute smart contracts, Dapps, transactions, or store data off-chain and later deploy it on the L1 to reduce load the L1 chains. The purpose of building L2 Blockchain is to scale the decentralised infrastructure to support more number of transactions, support higher storage, and help Dapps scale and operate efficiently without overcrowding the L1 while maintaining all the benefits of L1 Chains.

What are the top 10 layer 1 blockchains?

Is Solana Layer 1 or 2 blockchain?

Solana is a prominent Layer 1 Blockchain. It addresses the challenges of security, efficiency (speed), and decentralization. Solana can process upto 1000 transactions per seconds without the need of a layer-2 protocol.