Table of Contents

Solana DEX (Decentralized Exchanges) ecosystem has evolved into one of the most vibrant and innovative sectors in the cryptocurrency space. These platforms leverage Solana’s high-speed, low-cost infrastructure to provide traders with various trading mechanisms, from automated market makers (AMMs) to order books and hybrid solutions. Each decentralized exchange brings unique features and innovations to address specific market needs, from casual traders to professional market makers. This comprehensive analysis examines the distinctive properties, target audiences, and technological innovations of the leading decentralized exchange (DEXes) in the Solana ecosystem.

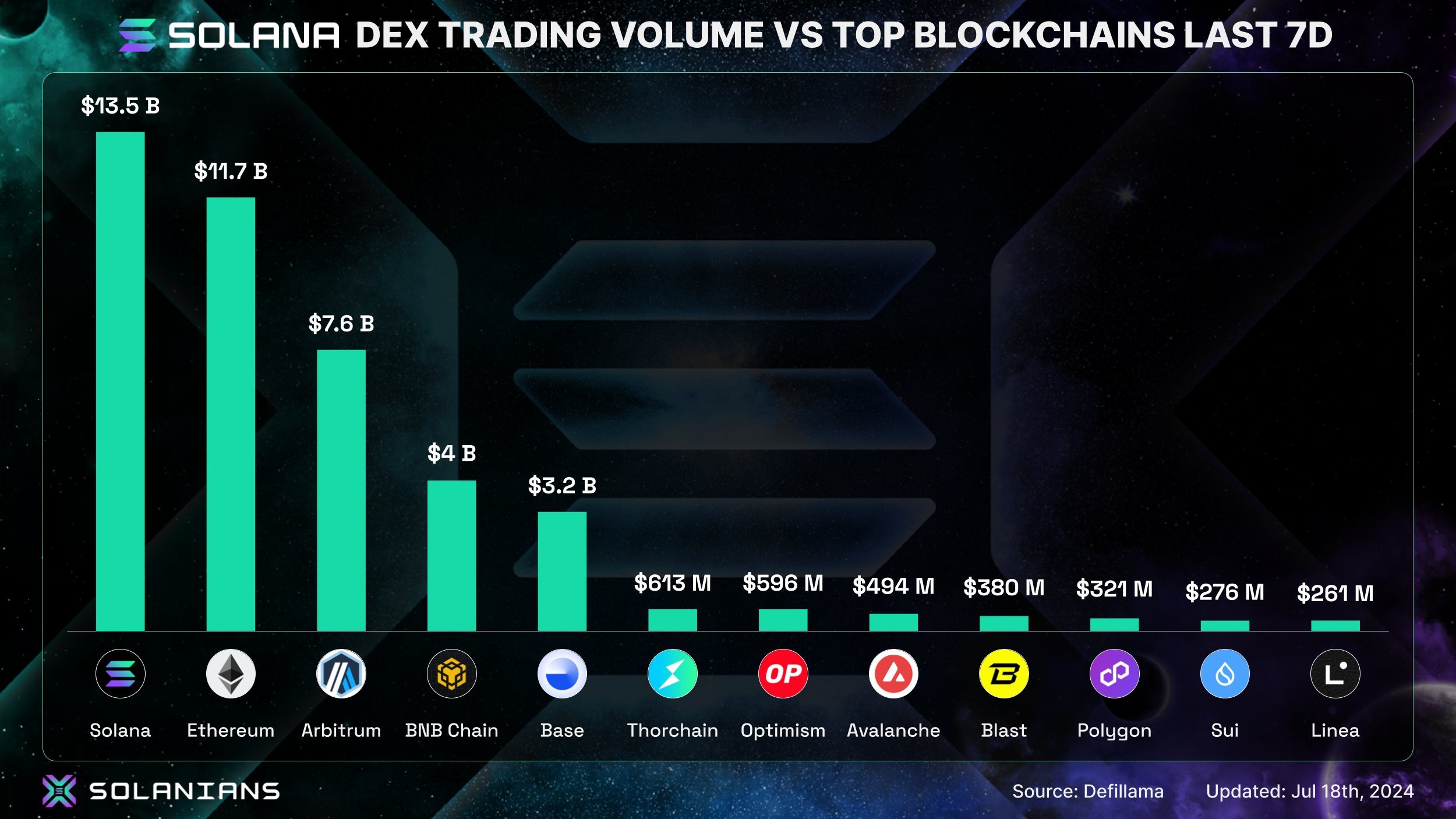

Solana has the highest Decentralized Exchange(DEX) volume in comparison to any other blockchain – Source: Defillama.

20 Solana DEX – Decentralized Exchanges to Explore

1. Raydium

Trading Type: Hybrid (AMM + Order Book)

Native Token: RAY

Launch Date: February 2021

Integration: Serum’s order book

Features Overview:

Raydium stands out because of its hybrid approach, combining the efficiency of an AMM with the precision of an order book system. The platform integrates with Serum’s order book infrastructure, providing users with enhanced liquidity and trading options. The platform’s yield farming mechanisms allow users to stake their assets in various pools with dynamic reward structures. Its price impact protection system actively monitors and adjusts trades to prevent price slippage, while its multi-token pools enable complex trading strategies and enhanced capital efficiency. The platform also provides features like NFT staking.

2. Jupiter

Trading Type: Decentralized Exchange Aggregator

Native Token: JUP

Launch Date: October 2021

Trading Volume: Highest on Solana

Features Overview:

Jupiter has revolutionized trading on Solana DEX through its sophisticated aggregation protocol. The platform’s routing algorithm splits trades across multiple DEXes and liquidity pools to ensure the best possible execution price. What sets Jupiter apart is its ability to execute these complex routes without charging additional fees beyond the necessary network costs. The platform’s direct wallet integration streamlines the entire trading process for users, while its price impact analysis helps traders make informed decisions. Jupiter’s liquidity aggregation spans the entire Solana ecosystem, creating a unified trading experience across disparate platforms. The limit order functionality is another major addition to its utility, allowing traders to set target prices for automated execution.

3. Orca

Trading Type: Pure AMM

Native Token: ORCA

Launch Date: February 2021

Special Features: Fair price pools

Features Overview:

Orca has distinguished itself through its seamless user experience and innovative pool mechanics. The platform’s fair price pools implement optimized algorithms to minimize impermanent loss for liquidity providers while maintaining competitive rates for traders. The platform’s double-sided staking mechanism provides additional yield opportunities while promoting platform stability. Orca’s user interface sets a new standard for accessibility in DeFi, making complex trading operations intuitive for newcomers. The custom fee tier system allows dynamic adjustment based on pool characteristics and market conditions.

4. Marinade Finance

Trading Type: Liquid Staking + DEX

Native Token: MNDE

Launch Date: July 2021

Infrastructure: mSOL

Features Overview:

Marinade Finance has redefined Solana staking through its innovative liquid staking protocol. The platform’s automated stake management system distributes delegations across a carefully selected network of validators, optimizing for both security and returns. Their sophisticated validator selection algorithm continuously analyzes performance metrics and adjusts stake distribution accordingly.

Through mSOL, their liquid staking token, users maintain portfolio flexibility while earning staking rewards, as mSOL can be utilized across the Solana DeFi ecosystem for lending, trading, and yield farming. The platform’s stake pool rebalancing mechanism ensures optimal distribution of stake across validators, while their governance system enables community participation in key protocol decisions. Marinade’s integration capabilities have made it a cornerstone of Solana’s DeFi infrastructure, with mSOL becoming a widely accepted form of collateral across the ecosystem.

5. Lifinity

Trading Type: Proactive Market Making AMM

Native Token: LFNTY

Launch Date: December 2021

Features Overview:

Lifinity’s proactive market-making algorithms set it apart in the automated market-making sector. The platform implements a dynamic fee structure that adjusts based on market volatility and trading volume, optimizing returns for liquidity providers while maintaining competitive rates for traders. Their concentrated liquidity positions allow for more efficient capital deployment, with liquidity providers able to focus their assets within specific price ranges for maximum yield potential. The protocol’s loss protection mechanisms use advanced mathematical models to minimize risk for liquidity providers. Lifinity’s cross-pool arbitrage system helps maintain price consistency across the platform while generating additional revenue for participants.

6. Step Finance

Trading Type: Aggregator + Portfolio Management

Native Token: STEP

Launch Date: April 2021

Features Overview:

Step Finance combines comprehensive portfolio management with sophisticated trading capabilities, creating an all-in-one platform for Solana DeFi users. Their dashboard provides real-time analytics across all Solana protocols, offering users unprecedented visibility into their DeFi activities. The platform’s swap aggregator implements smart routing algorithms to find the best prices across multiple decentralized exchanges, while their yield farming aggregator automatically identifies and ranks farming opportunities based on risk-adjusted returns.

Step’s transaction tracking system maintains detailed records of all user activities, simplifying tax reporting and portfolio analysis. Their risk management tools include impermanent loss calculators and portfolio diversification metrics, helping users make informed decisions. The platform’s automation features allow users to set up recurring transactions and automated portfolio rebalancing, streamlining the management of complex DeFi positions.

7. Saber

Trading Type: Stablecoin AMM

Native Token: SBR Launch

Date: June 2021

Features Overview:

Saber has established itself as the premier stable-asset exchange platform on Solana, specifically optimized for trading pairs that should theoretically maintain a fixed price relationship. Their specialized AMM design implements unique curves that minimize slippage for stable-asset trades while maximizing capital efficiency. The platform’s cross-chain asset support enables seamless trading between wrapped assets from various blockchain networks, facilitating inter-blockchain liquidity. Saber’s stable swap optimization uses advanced mathematical models to maintain tight spreads even during periods of high volatility. Their farming incentives program strategically distributes rewards to maintain deep liquidity across all supported pairs.

8. Atrix

Trading Type: Multi-token AMM

Native Token: ATRIX

Launch Date: September 2021

Features Overview:

Atrix distinguishes itself through its approach to multi-token liquidity pools and yield optimization strategies. The platform’s dynamic pool weight system allows for automatic rebalancing based on market conditions, optimizing returns while minimizing impermanent loss. Their yield optimization engine continuously analyzes and adjusts positions across various protocols to maximize returns for liquidity providers. The protocol’s liquidity bootstrapping mechanism implements a gradual price discovery process for new tokens, reducing the impact of volatility during initial trading periods. Atrix’s portfolio rebalancing tools enable users to maintain desired asset allocations automatically, while their risk management system monitors and alerts users to potential issues.

9. Aldrin

Trading Type: Professional Trading decentralized exchange

Native Token: RIN

Launch Date: March 2021

Features Overview:

Aldrin brings professional-grade trading features to the decentralized finance space, catering to sophisticated traders and institutions. Their advanced trading interface incorporates professional charting tools, technical analysis indicators, and customizable workspace layouts. The platform’s order execution engine supports a wide range of order types, including conditional orders, trailing stops, and time-weighted average price (TWAP) orders. Aldrin’s portfolio management system provides detailed analytics and performance metrics, helping traders optimize their strategies. Their price analytics suite includes advanced order book visualization and market depth analysis tools. The platform regularly hosts trading competitions to enhance community engagement and showcase its capabilities. Aldrin’s educational resources include comprehensive guides and tutorials, making advanced trading concepts accessible to users of all experience levels.

10. Invariant Protocol

Trading Type: Concentrated Liquidity AMM

Native Token: INV

Launch Date: January 2022

Features Overview:

Invariant Protocol has revolutionized liquidity provision on Solana through its sophisticated concentrated liquidity implementation. The protocol’s customizable fee tier system allows liquidity providers to optimize their positions based on asset volatility and trading volume. Their capital efficiency optimization engine enables providers to concentrate liquidity within specific price ranges, significantly improving trading efficiency and reducing slippage. The platform’s advanced analytics suite provides detailed insights into pool performance, helping liquidity providers make informed decisions about position management. Their risk management tools include impermanent loss calculators and position monitoring systems that alert providers to potential risks. Invariant’s liquidity mining program implements innovative reward mechanisms that incentivize stable, long-term liquidity provision while discouraging opportunistic behavior.

11. Saros Finance

Trading Type: Cross-chain decentralized exchange

Native Token: SAROS

Launch Date: March 2021

Features Overview:

Saros Finance specializes in facilitating cross-chain trading and liquidity provision, bridging assets across multiple blockchain networks. Their innovative bridge mechanism ensures secure and efficient asset transfers while maintaining decentralized principles. The platform’s smart routing system optimizes cross-chain trades by finding the most efficient paths across different networks and liquidity pools. Saros implements a unique yield farming structure that rewards users for providing liquidity to cross-chain pairs, enhancing overall market depth. Their risk management system includes sophisticated monitoring of bridge operations and cross-chain transactions, ensuring the security of user assets. The platform’s analytics suite provides comprehensive insights into cross-chain trading activities and liquidity distribution across networks.

12. Crema Finance

Trading Type: Hybrid Concentrated Liquidity

Native Token: CREMA

Launch Date: December 2021

Features Overview:

Crema Finance as a decentralized exchange combines traditional AMM functionality with concentrated liquidity features to create a unique trading experience. Their hybrid model allows liquidity providers to benefit from both passive market-making and active liquidity management strategies. The platform’s smart order routing system optimizes trade execution by analyzing multiple liquidity sources and price ranges. Crema’s position management tools enable providers to adjust their liquidity ranges and fee tiers based on market conditions. Their innovative fee structure implements dynamic adjustments based on volatility and trading volume, maximizing returns for liquidity providers while maintaining competitive rates for traders. The platform’s analytics suite provides detailed insights into pool performance and market trends.

13. Dexlab

Trading Type: Token Launchpad + Decentralized Exchange(DEX)

Native Token: DXL

Launch Date: June 2021

Features Overview:

Dexlab combines traditional decentralized exchange (DEX) functionality with comprehensive token launch capabilities. Their token minting platform provides projects with advanced tools for token creation and distribution, including customizable tokenomics and vesting schedules. The platform’s market-making algorithms ensure sufficient liquidity for newly launched tokens while preventing price manipulation.Dexlab’s trading interface includes professional-grade charting tools and advanced order types, catering to both retail and institutional traders. Their project incubation system provides comprehensive support for new projects, including technical assistance and marketing support. The platform’s governance system enables community participation in project selection and protocol development decisions.

14. Mango Markets

Trading Type: Margin Trading decentralized exchange

Native Token: MNGO

Launch Date: August 2021

Features Overview:

Mango Markets revolutionizes decentralized trading by offering sophisticated margin trading and lending capabilities and thus the trading type is a margin trading decentralized exchange. Users can effectively handle collateral across positions using their margining system to make the most of capital efficiency. To ensure investment safety and manage risk effectively the platform’s risk management engine keeps an eye on position health and initiates liquidation processes as needed.

Additionally, they have an insurance fund in place for added security, during market conditions and their range of order types allows users to implement intricate trading strategies effectively. The lending system, on the platform, lets users make profits from their deposited assets while still having control, over their funds management decisions. Token holders can also actively engage in determining protocol aspects and risk management strategies through the governance system in place.

15. Hydraswap

Trading Type: Multi-Pool decentralized exchange DEX

Native Token: HYDRA

Launch Date: January 2022

Features Overview:

Hydraswap’s multi-pool architecture enables efficient trading across various pool types simultaneously. Their smart routing system automatically splits trades across multiple pools to achieve optimal execution prices. The platform’s liquidity aggregation mechanism combines different pool types including constant product, stable, and concentrated liquidity pools. Hydraswap’s yield optimization engine automatically redistributes liquidity across pools based on performance metrics. Their risk management system includes comprehensive monitoring of pool health and automatic rebalancing mechanisms.

16. Eclipse

Trading Type: Privacy-Focused DEX

Native Token: ECLP

Launch Date: May 2022

Features Overview:

Eclipse prioritizes trading privacy while maintaining compliance and regulatory requirements. Their protocol implements zero-knowledge proofs for transaction privacy while ensuring transparent price discovery and thus is a privacy-focused decentralized exchange. The platform’s matching engine enables confidential order execution without compromising trading efficiency. Eclipse’s liquidity pooling system allows providers to maintain privacy while earning yields. The cryptographic systems used ensure secure trading while providing necessary compliance reporting capabilities. The platform’s integration with privacy-preserving cross-chain bridges enables confidential trading of wrapped assets from other networks. Their governance mechanism allows token holders to participate in protocol decisions while maintaining their privacy preferences.

17. Drift Protocol

Trading Type: Perpetual decentralized exchange

Native Token: DRIFT

Launch Date: November 2021

Features Overview:

Drift Protocol specializes in decentralized perpetual futures trading with advanced risk management features. Their funding rate mechanism ensures stable and efficient price discovery for perpetual markets. The platform’s insurance fund system provides comprehensive protection against extreme market events and cascading liquidations. Drift’s advanced order types include take-profit, stop-loss, and trailing stop orders, catering to sophisticated trading strategies. They also implement real-time monitoring and automated liquidation procedures to maintain system stability.

18. Hedge Decentralized Exchange

Trading Type: Options Trading decentralized exchange DEX

Native Token: HEDGE

Launch Date: June 2022

Features Overview:

Hedge Decentralized Exchange brings sophisticated options trading to the Solana ecosystem. Their options protocol enables users to create, trade, and exercise both call and put options with various strike prices and expiration dates. The platform’s advanced pricing model implements Black-Scholes calculations with modifications for cryptocurrency market dynamics. Hedge’s risk management system includes comprehensive Greek calculations and position monitoring tools. Their liquidity provision system enables market makers to efficiently provide options liquidity.

19. Sonar

Trading Type: Social Trading decentralized exchange

Native Token: SONAR

Launch Date: March 2022

Features Overview:

Sonar combines traditional decentralized exchange functionality with innovative social trading features. Their platform enables users to follow successful traders and automatically copy their trading strategies with customizable parameters. The social analytics system provides detailed performance metrics and risk analysis for different trading strategies. Sonar’s reputation system helps users identify reliable strategy providers while incentivizing consistent performance. Their automated trading engine enables efficient strategy execution while maintaining full user control over funds.

20. Phoenix

Trading Type: Rebasing Token decentralized exchange

Native Token: PHX

Launch Date: July 2022

Features Overview:

Phoenix as a decentralized exchange specializes in trading and managing rebasing tokens with sophisticated price stability mechanisms. Their innovative protocol automatically adjusts supply parameters based on market conditions to maintain price targets. The platform’s staking system implements elastic rewards that adjust based on market conditions and protocol performance. Phoenix’s risk management suite includes specialized tools for handling rebasing tokens and their unique economic characteristics. Their analytics platform provides detailed insights into supply adjustments and price stability metrics. The protocol’s governance system enables token holders to participate in decisions regarding rebase parameters and stability mechanisms.

Conclusion

This comprehensive analysis covers the top 20 decentralized exchanges in the Solana ecosystem, each bringing unique innovations and capabilities to the market. The diversity of approaches and specializations demonstrates the maturity and sophistication of Solana’s DeFi landscape, providing users with a wide range of tools and opportunities for trading and investment.

Solana’s DEX space is not just about creating simple token swaps – it’s about building sophisticated financial infrastructure that can compete with traditional markets while maintaining decentralization principles. From a developer’s standpoint, building decentralized exchanges on Solana presents unique opportunities that align perfectly with the ecosystem’s diverse landscape but decentralized exchanges as applications are useful not just for Solana but for any growing ecosystem. Learn to build a Decentralized Exchange on Sui with Metaschool.