Table of Contents

Introduction

Tokenization of Real-World Assets (RWAs) is a new norm in the investment world, enabling fractional ownership and increased liquidity for assets that have historically been illiquid. Investors can now access a broader universe of asset classes—ranging from real property to art—through blockchain and AI, which is transforming our conception of ownership and investment.

What is Tokenization of Real-World Assets?

Tokenization refers to the process of converting the ownership right of a physical asset into a digital token on a blockchain. A token represents a specific fraction of the asset, and the tokens can be easily transferred among parties.

Example: Real Estate: An apartment valued at $1 million can be tokenized into 1,000 tokens of $1,000 each. Different numbers of tokens can be purchased by investors.

- Asset Valuation: One asset is comprehensively valued to determine its value.

- Smart Contracts: Smart contracts are developed on a blockchain to define rights, obligations, and ownership.

- Token Creation: Tokens that represent the asset are minted and distributed to investors.

- Trading and Liquidity: Tokens are fungible on secondary markets and increase liquidity.

The Role of AI in Asset Tokenization

AI significantly enhances the tokenization process through the improvement of asset valuation, risk analysis, compliance checks, and trading algorithms. AI software surveys terrain, market trends, and past data to provide accurate valuations.

Example: AI-Driven Platforms

- DigiShares: Utilizes AI to optimize fundraising by analyzing investor behavior and preferences.

Advantages of Tokenizing Real-World Assets

Tokenization offers several advantages that benefit investors as well as asset owners:

Increased Liquidity

- Traditional assets like real estate are often illiquid; tokenization allows for quicker transactions and easier access to a worldwide pool of investors.

Fractional Ownership

- Investors can purchase partial interests in expensive assets, making investment more available to the masses and enabling diversification of portfolios.

Transparency and Security

- Blockchain ensures that all transactions remain transparent and secure, reducing fraud and dispute.

Efficient Processes

- Smart contract efficient transactions reduce the use of intermediaries, lowering costs and improving efficiency.

Tokenization and Smart Contracts

Smart contracts play a pivotal role in ensuring the enforcement of contracts automatically upon fulfillment of conditions. Smart contracts also facilitate trustless transactions, reducing the utilization of third parties in tokenization.

Implementation Example

pragma solidity ^0.8.0;

contract AssetToken {

string public name;

string public symbol;

uint256 public totalSupply;

mapping(address => uint256) public balances;

constructor(string memory _name, string memory _symbol, uint256 _totalSupply) {

name = _name;

symbol = _symbol;

totalSupply = _totalSupply;

balances[msg.sender] = totalSupply;

function transfer(address _to, uint256 _value) public returns (bool success) {

require(balances[msg.sender] >= _value);

balances[msg.sender] -= _value;

balances[_to] += _value;

return true;

}

}Here, an asset is tokenized as an ERC-20 token, allowing for easy transferability and ownership identification.

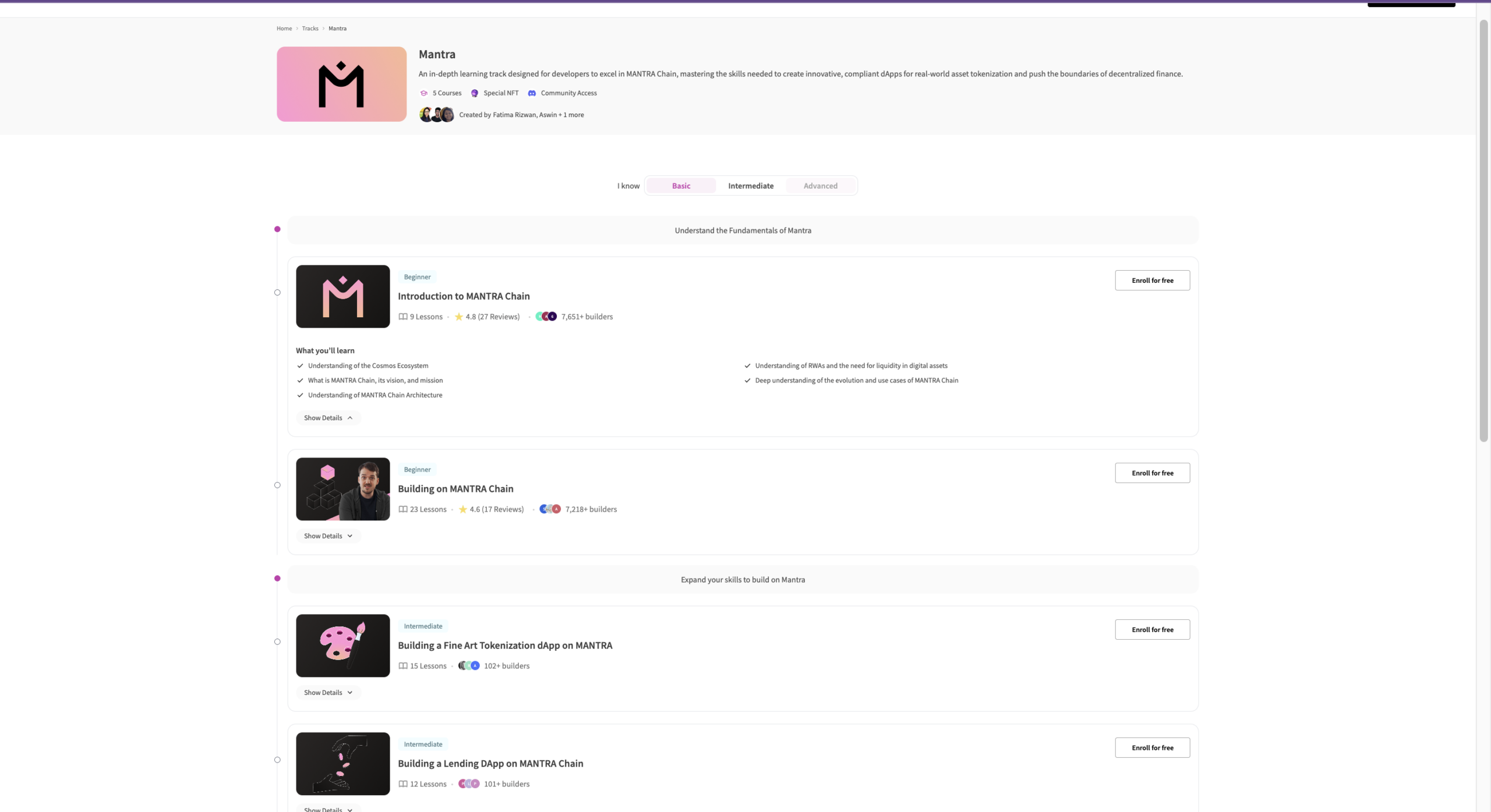

Tip: We have an entire learning track on MANTRA Chain which is the king in the world of Tokenization of Real World Assets. Learn to build with MANTRA CHAIN now!

Top Real-World Asset Tokenization Platforms

- RealT: Real estate oriented, offering fractional property ownership in the form of blockchain tokens.

- Mattereum: Bridges real-world assets to the blockchain, allowing legal enforceability of ownership.

- Wine Vault: Tokenizes wine, giving investors the power to own pieces of costly bottles.

Comparison of Features

| Platform | Asset Types | Token Standard | Fees |

|---|---|---|---|

| RealT | Real Estate | ERC-20 | 1% |

| Mattereum | Varied Assets | ERC-721 | 0.5% |

| Wine Vault | Fine Wine | ERC-20 | 2% |

Real-World Use Cases

- Fractional Art Ownership: Sites like Maecenas allow individuals to invest in high-value art, where each token owns a fraction of it.

- Real Estate Tokens: Tokenization is applied by property management firms to offer ownership stakes in residential and commercial real estate via platforms like RealT.

Conclusion & Key Takeaways

The revolutionizing of the financial world comes from tokenizing real-world assets using AI. Compelling benefits in this context are increased liquidity, fractional ownership, and more supply chain transparency. While it sounds promising, a lot has to be learned on the platform and assets by an investor before the investment can take place. All this comes into play through the use of AI and smart contracts, allowing access and convenience for new levels of investment.

Key Takeaways:

- Tokenization democratizes access to investments.

- AI enhances valuation accuracy and risk management.

- Learn about platform functionalities and legal consequences prior to investing.

Q1: Is tokenization safe?

While blockchain technology provides added security, caution in judging assets and platforms is essential. Always do your due diligence.

Q2: Can any asset be tokenized?

Any asset can be tokenized, but legal concerns could vary by jurisdiction and asset class.

Q3: What if the market fluctuates?

Similar to any investment, tokenized assets are subject to market risks. But with diversification through fractions, risks can be minimized.