Table of Contents

The DeFi space is growing massively, there is so much data to be analyzed regarding transactions and investments. It is nearly impossible to keep track of such a huge amount of data across multiple sites, this is where DexScreener comes in. It is an analytics platform regressively used in the DeFi ecosystem, providing real-time data and analysis tools for decentralized exchanges (DEXs) across multiple chains. With the evolution of the DeFi space, DexScreener has become an essential tool for traders, investors, and analysts.

Understanding the Core Functionality

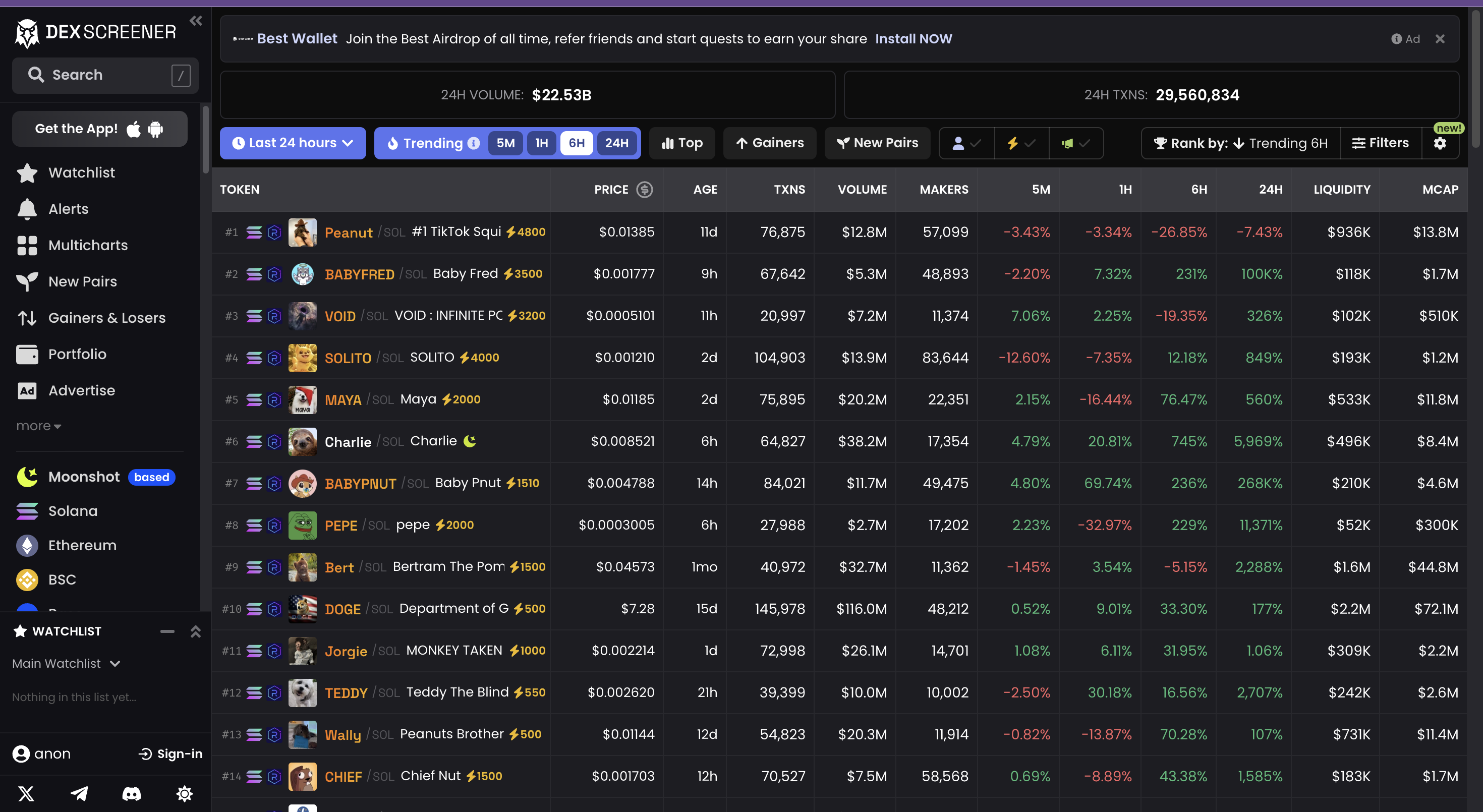

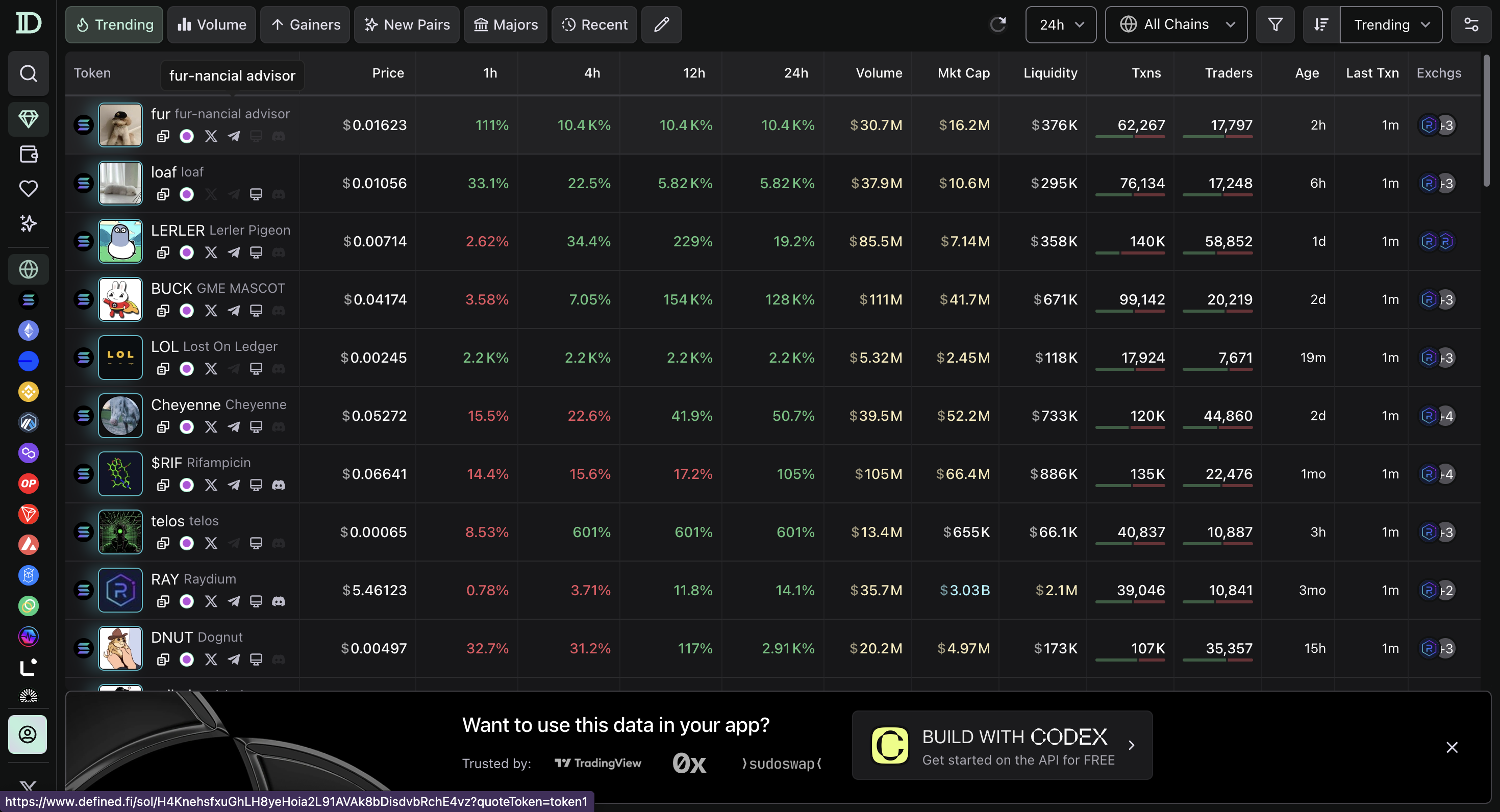

The DexScreener software aggregates real-time trading data from multiple decentralized exchanges and blockchain networks. Additionally, the platform provides a simple interface that allows users to track trading pairs, analyze price movements, and monitor liquidity across multiple DEXs at once in addition to collecting and processing a vast amount of blockchain data. In contrast to conventional exchange platforms, DexScreener focuses exclusively on decentralized protocols, providing specialized insight into DEX trading’s unique aspects.

Technical Architecture and Data Collection

DexScreener operates through a system of blockchain nodes and data indexers that continuously monitor smart contract interactions across all supported networks. The platform maintains connections to multiple blockchain networks, including Solana, Ethereum, Polygon, Binance Smart Chain, and others, enabling real-time data collection from smart contracts governing DEX protocols. This data is processed through specialized algorithms that clean, normalize, and index the information for rapid retrieval and analysis.

Advanced Analytics and Trading Metrics

The platform provides a comprehensive suite of analytical tools that go beyond basic price and volume data. Traders can access detailed metrics such as liquidity depth, price impact calculations, trading volume distribution, and holder analytics. These metrics are crucial for understanding market dynamics in the DEX environment, where liquidity and price discovery mechanisms differ significantly from traditional markets.

Market Manipulation Detection and Security Features

One of DexScreener’s most valuable features is its ability to help users identify potential market manipulation and security risks. The platform incorporates various indicators and warning systems that flag suspicious trading patterns, unusual liquidity movements, and potential smart contract risks. This includes monitoring for common DeFi exploitation techniques such as flash loans, sandwich attacks, and liquidity pulls.

Cross-Chain Integration and Multichain Support

Modern DeFi ecosystem operates across multiple blockchain networks, and DexScreener addresses this reality through robust cross-chain support. Users can seamlessly switch between different networks while maintaining a consistent interface and analytical framework. This multi-chain capability is particularly valuable for traders engaging in cross-chain arbitrage or managing portfolios across different blockchain ecosystems.

Trading Pair Analysis and Discovery

The platform excels in providing detailed analysis of trading pairs, offering users the ability to discover new opportunities and assess trading risks. Each trading pair page includes comprehensive information about token contracts, liquidity provider distributions, trading history, and price correlations. This depth of information enables traders to make informed decisions about potential trades and investment opportunities.

Real-Time Trading Tools and Interfaces

DexScreener provides real-time trading tools that help users execute informed trades directly through their preferred DEX. The platform includes features such as price alerts, volume notifications, and customizable watchlists. These tools are designed to help traders respond quickly to market opportunities while maintaining a comprehensive view of market conditions.

Alternative DEX Analytics Platforms

While DexScreener has established itself as a prominent player in the DEX analytics space, several alternative platforms offer similar or complementary functionality. Understanding these alternatives helps traders make informed decisions about which tools best suit their needs.

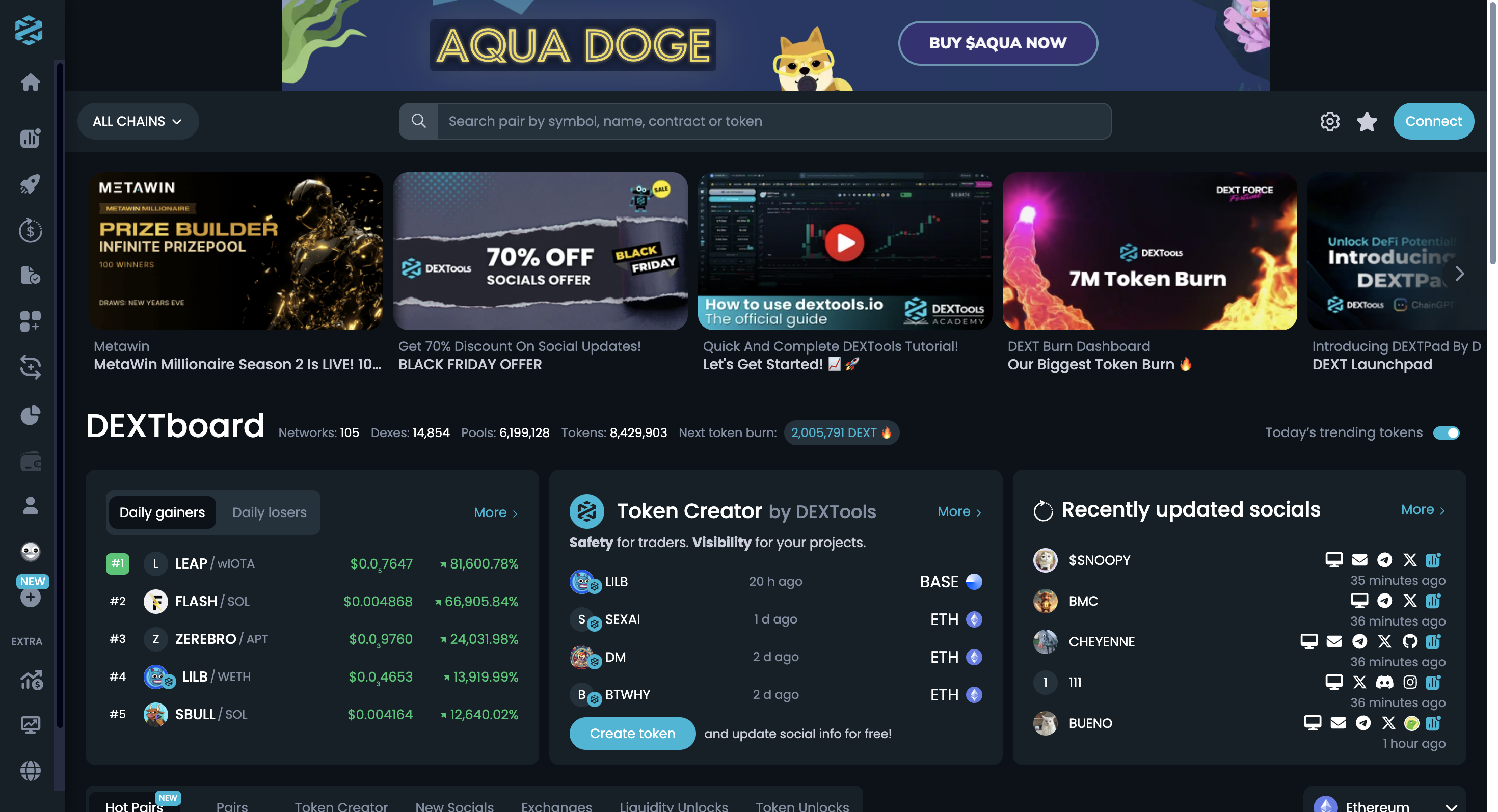

DexTools

DexTools is one of the most popular alternatives to DexScreener, particularly known for its comprehensive suite of trading tools on the Ethereum network. Its flagship product, DexTools Pro, offers advanced features such as:

- Real-time pair explorer with detailed trading information

- Social sentiment analysis and trending pairs

- Advanced charting capabilities with multiple technical indicators

- Whale wallet tracking and monitoring

- Multi-chart layouts for professional traders

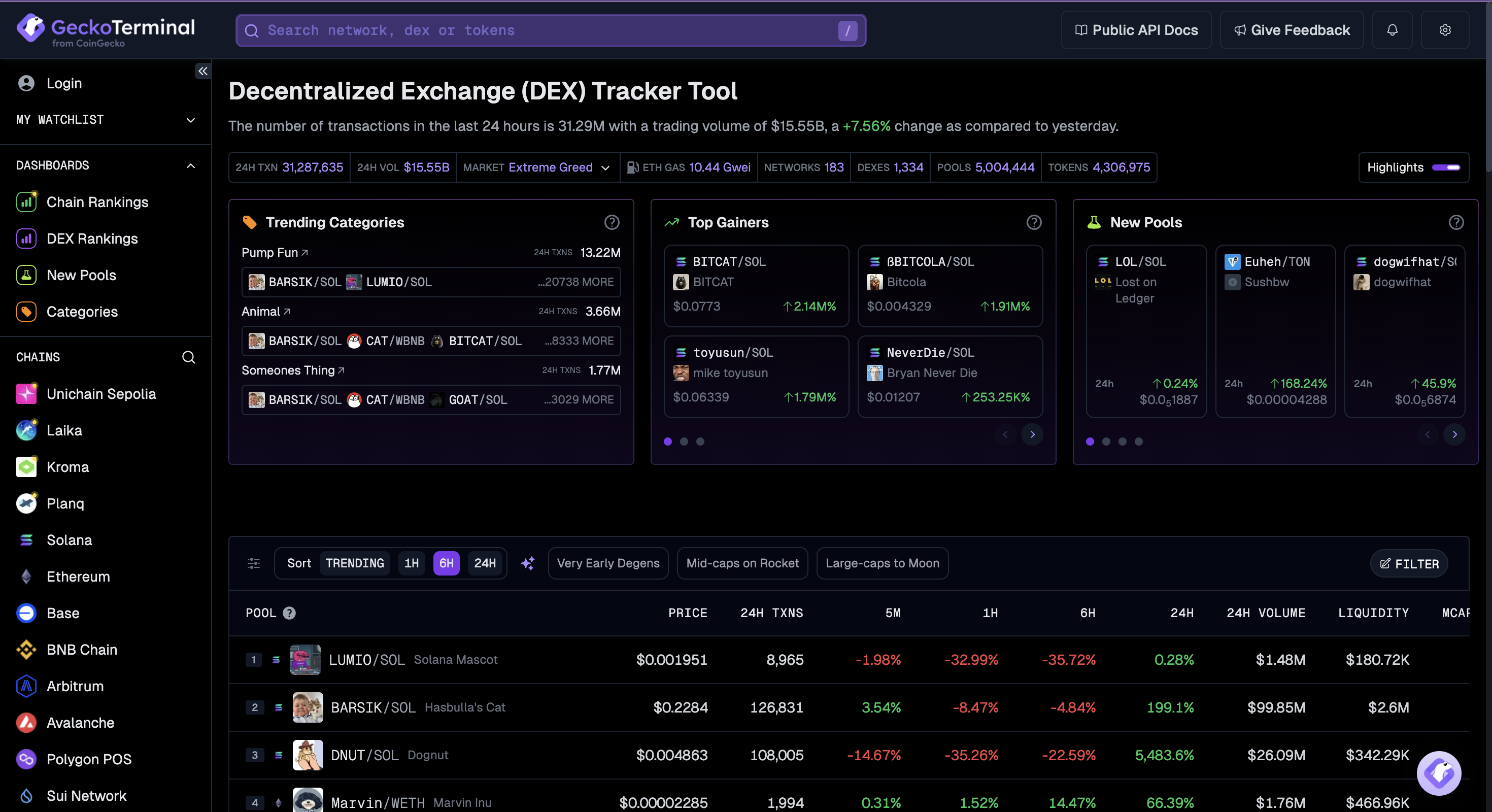

GeckoTerminal

GeckoTerminal, developed by the renowned cryptocurrency data aggregator CoinGecko, provides a user-friendly interface for DEX trading analysis. Key features include:

- Integration with CoinGecko’s extensive cryptocurrency database

- Clean, intuitive interface suitable for beginners

- Real-time trading data and charts

- Multi-chain support with emphasis on emerging networks

- Free access to basic features

Defined.fi (formerly DEX Guru)

Defined.fi positions itself as a professional-grade DEX analytics platform, It shows real-time token prices, charts, wallet tracking, and trading terminals for every popular network including Ethereum, Solana, Base, Arbitrum, and Optimism. The key features include:

- Advanced order flow analysis

- Institutional-grade trading tools

- Cross-chain portfolio management

- Proprietary market indicators

- API access for institutional clients

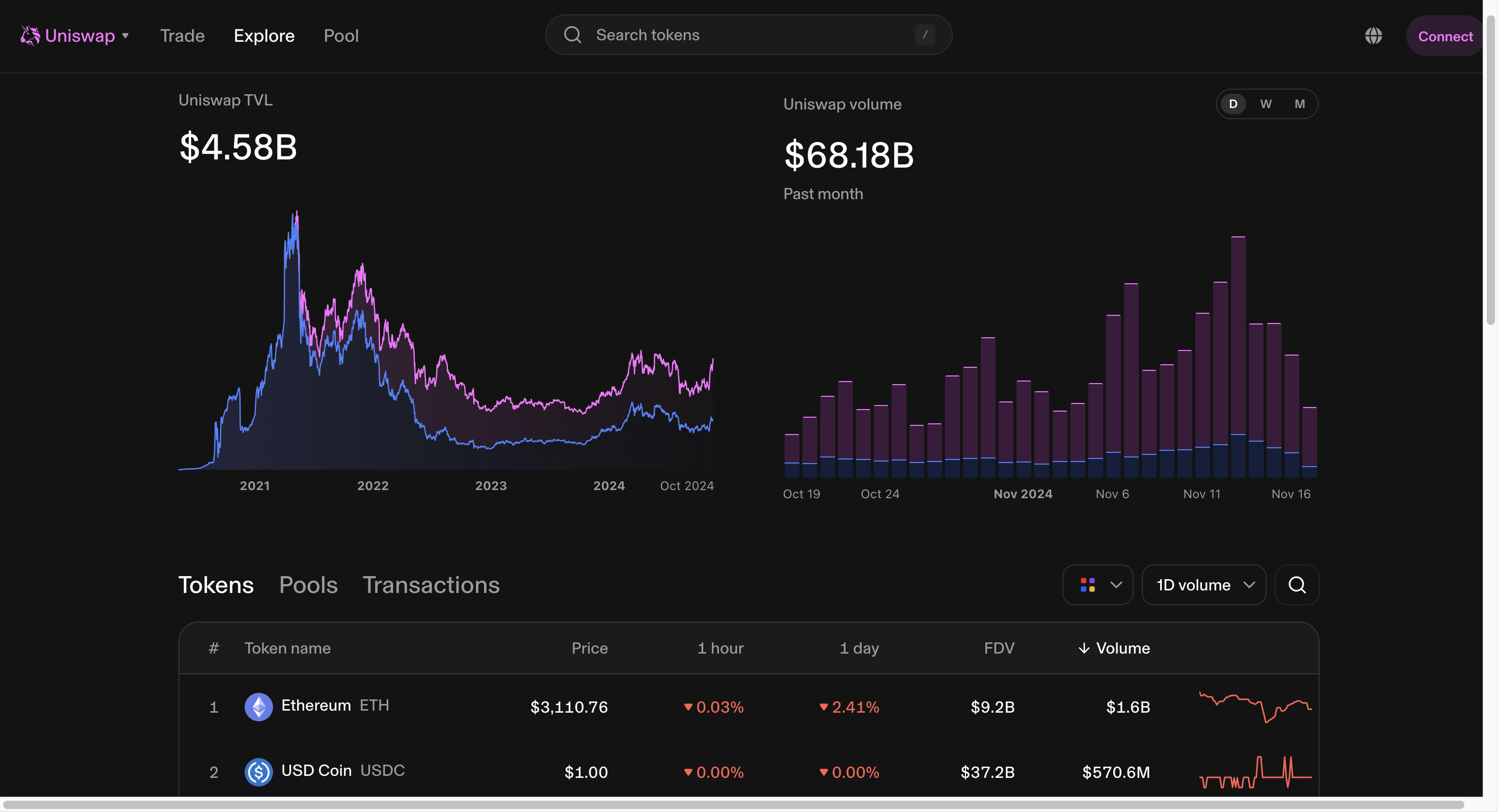

UniswapInfo

UniswapInfo is a product of Uniswap. It provides a high-level data about exchanges on Uniswap. Detailed stats like 24-hour volume, total liquidity, and daily transactions are available. The top exchanges are sorted by price, volume, liquidity, and more to help users explore different aspects of the most active pools. It is more specialized, UniswapInfo provides detailed analytics specifically for Uniswap protocols:

- Deep insights into Uniswap v2 and v3 pools

- Concentrated liquidity position analysis

- Historical data and volume analytics

- Protocol-specific metrics and indicators

Comparative Advantages

Each platform has its unique strengths:

- DexScreener excels in providing a balanced combination of features and user-friendly interface

- DexTools offers the most comprehensive technical analysis tools

- GeckoTerminal provides the best integration with traditional crypto market data

- Defined.fi caters to professional and institutional traders

- UniswapInfo offers the deepest protocol-specific analytics

API Integration and Developer Resources

For developers and institutional users, DexScreener offers robust API access that enables integration with external trading systems and analytical platforms. The API provides programmatic access to historical data, real-time market feeds, and advanced analytics, allowing for the development of custom trading solutions and automated trading systems.

Future Developments and Platform Evolution

As the DeFi ecosystem continues to evolve, DexScreener maintains a forward-looking development approach, regularly introducing new features and expanding its capabilities. Recent developments include enhanced support for new DEX protocols, improved analytics for newer trading mechanisms like concentrated liquidity pools, and expanded cross-chain monitoring capabilities.

Conclusion

DexScreener is an important infrastructure tool in the blockchain ecosystem. It provides essential tools for not just understanding but also navigating decentralized markets irrespective of what network the DEX is built on. DEX traders who are serious about DEX trading will find this tool indispensable thanks to the combination of real-time data with sophisticated analytics, as well as comprehensive market coverage. With the maturing of DeFi, platforms like DexScreener will play an increasingly important role in providing transparency and analytical capabilities that make the market more efficient. Since we have been discussing DEXs a lot, learn to Build a Token DEX dApp on Sui with us!

Frequently Asked Questions(FAQs)

Where does DEX Screener get data from?

All DEX Screener data comes directly from the blockchains it tracks, without the use of any external APIs or data sources. It has a custom-built indexer to parse, analyze, and store raw blockchain logs, which are then used to create screeners, charts, and analytics. All data is processed automatically in real-time without any human moderation or intervention.

What is a DEX Screener used for?

With DEX Screener, users can easily monitor the price, trading volume, and on-chain trades of various tokens, and use that data to make informed decisions about their investments. With millions of users, DEX Screener is a trusted and widely used platform among crypto traders and investors.

Is trading on a DEX Screener safe?

Is Dexscreener safe? The Dexscreener itself is safe for data analysis. However, it is important to follow general security guidelines when connecting your wallet.

How does a DEX Screener get data?

All DEX Screener data comes directly from the blockchains it tracks, without the use of any external APIs or data sources. DS has a custom-built indexer to parse, analyze, and store raw blockchain logs, which is then used to create screeners, charts, and analytics.