Table of Contents

Short is a buy/sell method for Margin Trading where “Short” refers to selling your holdings at a high price and then buying at a low pricing. By doing this, crypto traders earn a profit from the price difference. But shorting is not straightforward as trading. Here’s a quick updated on how to short on binance and make profits form it.

Out of the numerous profit generation methods on Binance, shorting is one. If you are curious to know more about it, let’s take you through this quick guide on how to short on Binance.

In short, shorting is a trading method where you make profits from price declines on cryptocurrencies and digital assets. Getting into a shorting position will help you manage risk. You will also be able to hedge all your current holdings against the risk of price drop. Let’s talk a little more about shorting and explain how to short on Binance with examples.

🔎Relevant course: How to create a token on Binance

So, what exactly is Short on Margin Tarding?

In order to stay short, one has to borrow a cryptocurrency and sell it in exchange for the current price. You, then buy the digital currency at a later date and repay the capital borrowed. If the price of the coin has dropped, you will be able to make a profit on the difference between the cost of buying and selling.

🔮 Explore now: Who is Changpeng Zhao? Binance CEO & Founder

Here’s a quick example on shorting

Let’s assume, you believe that the price of Bitcoin is soon going to fall from its current price of $65,000. Therefore, you borrow 1 Bitcoin from an exchange and short sell at the current market value. This means you will be borrowing 1 Bitcoin at the current price of $65,000. After a week, assuming the price of one Bitcoin falls to $55,000.

This is where you re-purchase 1 Bitcoin and return it to the exchange you borrowed from. However, you will give them back 1 bitcoin at just $55,000 of new value.

In this scenario, you will end up securing a total profit of $10,000, the difference between the cost at borrowing vs selling ($65,000 – $55,000) respectively. Shorting provides the benefit of making a large amount of money as you short a volatile and risky asset like cryptocurrency. The potential is massive, but massive risks are involved too.

One risk is that if you’re in a short position and the prices of Bitcoin increases significantly. That can end up making you a loss instead of a profit. The spike up can quickly “trap” short sellers and over the years has shown to bankrupt many of those shorting. Since you borrowed 1 bitcoin at the price of $65,000 and after a week, the price goes up to $70,000, you’ll be forced to either hold your short position further or buy Bitcoin at the higher value to return it to the exchange you borrowed the asset from.

How to Use Short (Buy/Sell) on Binance – Margin Trading

Margin trading is a way to trade assets with funds given to you by a third party. Margin accounts can provide traders the opportunity to gain access to bigger amounts of capital. Then you can leverage your position with ease. While keeping that in mind, let’s take a look at how to short on margin trading.

Step 1 – Click on Wallet and Select Margin Wallet

You should initially log into your Binance trading account. You should then click on Wallet and select Margin Wallet.

Step 2 – Search for USDT

Once you’re done with those initial steps, you will need to search for USDT. After that, you may click on the button named “Transfer”.

Step 3 – Enter the USDT amount

Next, you will need to specific number of USDT that you wish to transfer out of your spot wallet into the margin wallet. Then you can pick the option named “Confirm Transfer”. Once you do it, you will be ready to go ahead with shorting your crypto.

🔥Popular course: Build a code translator using NextJS and OpenAI API

Step 4 – Search for a cryptocurrency

Now you can search for any cryptocurrency on the Margin Wallet. For example, if you want to short Bitcoin, you will need to search for BTC. Then click on the button named “Trade” and pick an appropriate crypto pair. For example, it can be BTC/USDT.

Step 5 – Sell your cryptocurrency

You should go to the section named “Sell BTC”. You can see it right under the price chart.

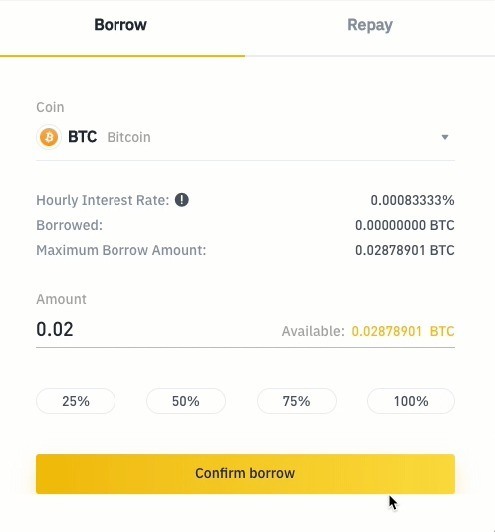

Step 6 – Borrow

Now you can click on the “Borrow” button. It will show the maximum BTC amount that you can borrow.

Step 7 – Place short order

In order to place the short sale order, you will need to specify the amount as well as the BTC that you plan to short. You can click on the button named “Margin Sell BTC”.

How to short on Binance – Options

You can use the Binance mobile app to short on Binance options. Mentioned below are the steps that you will need to follow to short on Binance options.

Step 1 – Download Binance app

You should first download Binance mobile app. The app is available on Google Play Store or Apple App store. After downloading the app, you need to log into it.

Step 2 – Activate futures

Next, you will need to activate Futures account on the app. This will help you proceed with starting trade options.

Step 3 – Go to Trades tab

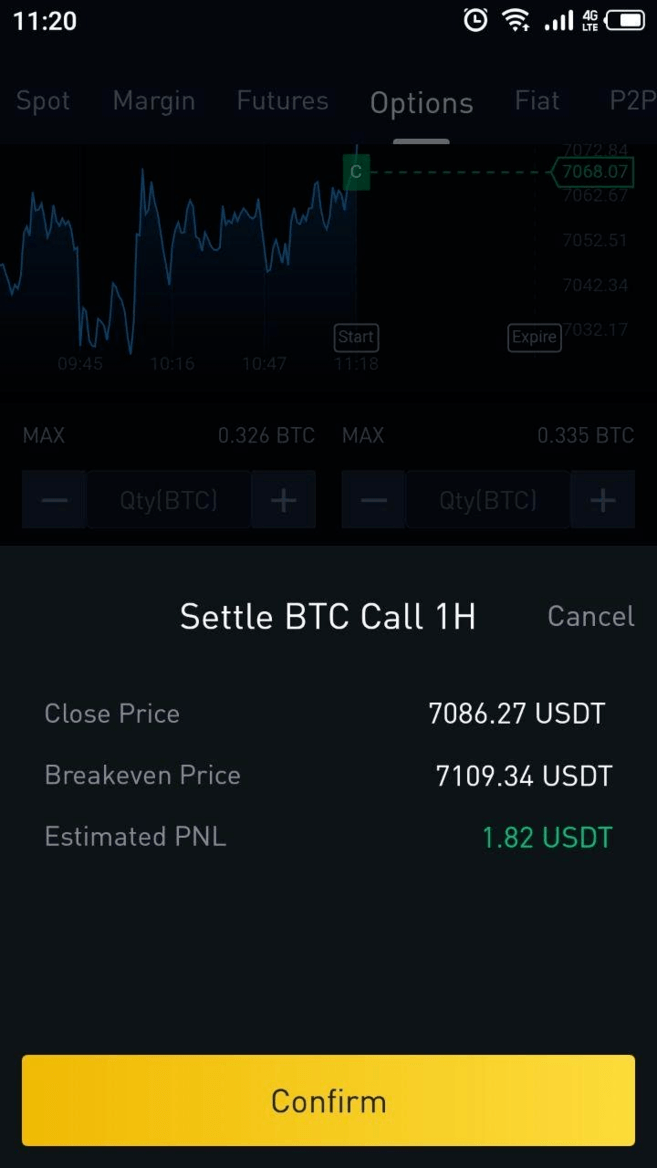

Image Source – academy.binance.com

As the next step, you will need to get to the tab named Trades. After that, you can click on “Options” button. In case if no funds are available on the Futures wallet, you will need to transfer funds from the Exchange Wallet into the Futures Wallet.

✅You don’t want to miss this: Write your first smart contract on Flow blockchain

Step 4 – Pick the expiry time

Now you will have five different options to select from. These options have different expiry times, which range from 10 minutes, 30 minutes, 1 hour, 8 hours, and 24 hours. You can pick the best option that you wish to purchase.

Step 5 – Specify contract size

Next, you should specify the exact contract size under the field named Quantity. After that click on Buy Call button.

Step 6 – Confirm

You can now see a confirmation window as a pop-up. Review the information and click on the Confirm button.

Step 7 – Sell open positions

Take a look at the tab named Positions, and you can see all open positions.

Step 8 – Settle

In order to close a position, you should click on the button named “Settle” which you can see on the right-hand side of the tab named Positions. After that, you can click on the Confirm button and execute the option.

Final Words on Short Selling on Binance

Now you are aware of how to short on Binance. The process of shorting any cryptocurrency on Binance is not difficult. All you have to do is adhere to the steps we’ve shared above and get your work done.

However, it is also important to understand that crypto markets are highly volatile. This means that the price of a specific cryptocurrency can increase or decrease within a matter of a few seconds. There won’t be any underlying reason for it as well. If you’re prepared to manage the risks before you short, you can expect to receive the best experience with it.

Hope you found this useful!

FAQs

What is the Binance Long/Short Ratio?

The Binance Long/Short ratio is a market sentiment analysis indicator that is mostly based on the opinions and actions of the participants in a market. The formula to calculate this ratio is: divide the number of long positions by the number of short positions. Long position refers to buying at a low price and selling at a high price. Short position refers to selling at a high price but buying at a low price. A high ratio denotes that the market is bullish and a low ration shows that the market is bearish.

Is there a Binance trading bot?

Yes, there is a Binance trading bot. It automates buying and selling on spot trading. It takes the user’s risk profile and the overall market condition to automate trades.

Can you short sell on Binance?

Yes, you can short sell on Binance. Here are the steps to do it in short:

Step 1: Enable margin account on Binance

Step 2: Choose account type

Step 3: Provide collateral for short positions

Step 5: Trade Bitcoin

Step 6: Repay the loan

Does Binance allow shorts?

Yes, Binance has inbuilt feature to enable traders to do short selling or shorting on cryptocurrencies. By placing a short order on Binance, a trader is basically borrowing BTC from Binance Futures with the hope of buying it back and returning it at a low price in the future to make a profit from the price drop.