Table of Contents

Definition: DeFi is short for Decentralized Finance, used as a broader term to refer to all peer-to-peer (decentralised) financial services on public blockchains such as Ethereum, Bitcoin, or Solana.

DeFi is among of the most revolutionary concepts in the world of finance and web3. It’s reshaping how we think about traditional financial systems by leveraging blockchain technology to create a more open and accessible financial ecosystem. If you’re new to the world of DeFi, this blog will help you understand what it is, how it works, and why it matters.

Understanding DeFi and Why is it Important?

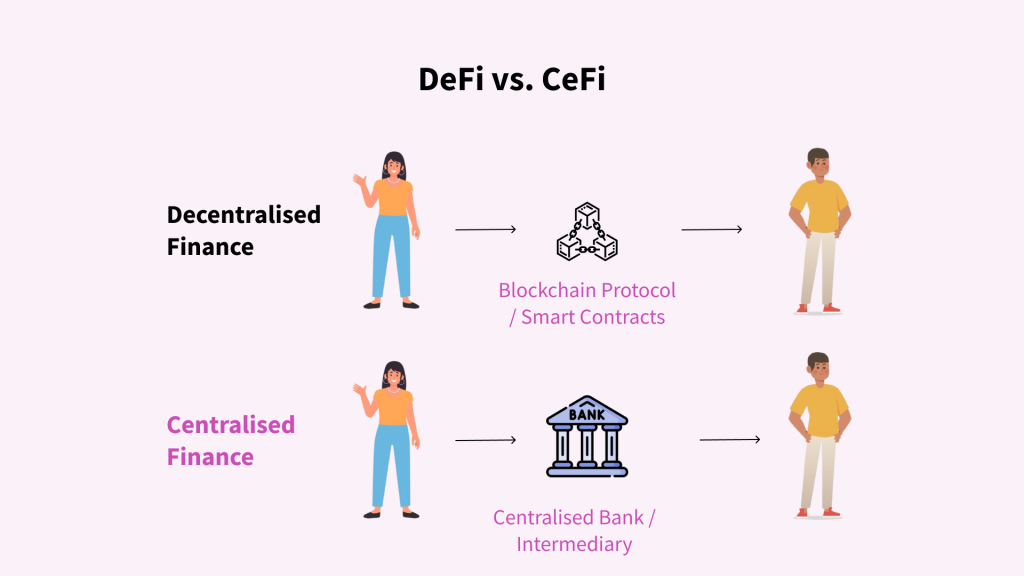

DeFi refers to a set of financial services that are built on blockchain networks, primarily Ethereum. Unlike traditional finance, which relies on centralized institutions like banks and brokerages, DeFi operates without intermediaries. Instead, it uses smart contracts—self-executing agreements with the terms of the contract directly written into code.

In simpler terms, DeFi allows you to do everything that traditional financial institutions do—like lending, borrowing, trading, and earning interest—but without the need for a bank or any other centralized authority.

Key Features of DeFi

- Decentralization: The core principle of DeFi is decentralization. No single entity controls the system. Instead, it’s governed by code and operated on a peer-to-peer basis. Since it is powered by Public blockchain, the benefits of public blockchain like security, traceability, and temper-proof are inherent.

- Accessibility: Anyone with an internet connection can access DeFi services. You don’t need a bank account, and there are no geographical restrictions. You also do not need to prove your identity in order to use DeFi.

- Transparency: All transactions and smart contracts are recorded on a public blockchain, making them transparent and easily verifiable by anyone. The public blockchain is the shared ledger that keeps track of all transactions ever happened.

- Interoperability: DeFi platforms often interact with each other, allowing users to move assets across different protocols and take advantage of various services. The interoperability ensures that as a DeFi user you are not tied to any one ecosystem and depending on from where you get more benefits, features, and security, you can bridge your bridge your assets and move.

- Programmability: Smart contracts enable the automation of complex financial processes, reducing the need for manual intervention. Things like lending, borrowing, saving, interests, etc. can be easily coded into the system.

Popular Use Cases of DeFi (Decentralised Finance)

- Lending and Borrowing: DeFi platforms like Aave and Compound allow users to lend their assets to others and earn interest or borrow assets by providing collateral. Unlike traditional lending, there’s no need for credit checks or lengthy approval processes.

- Decentralized Exchanges (DEXs): Platforms like Uniswap and SushiSwap allow users to trade cryptocurrencies directly with each other, without relying on a centralized exchange. This reduces the risk of hacks and provides users with more control over their assets.

- Stablecoins: These are cryptocurrencies that are pegged to a stable asset like the US dollar. Examples include DAI and USDC. Stablecoins play a crucial role in DeFi by providing a stable medium of exchange and store of value.

- Yield Farming: Yield farming involves lending or staking your assets in DeFi protocols to earn rewards, usually in the form of additional tokens. It’s like earning interest on your savings but with potentially higher returns.

- Insurance: DeFi platforms like Nexus Mutual provide decentralized insurance, allowing users to protect themselves against smart contract failures and other risks in the DeFi ecosystem.

Pros and Cons of DeFi

Just like with any other new technology, there are always a tradeoff between advantages and disadvantages. DeFi is new, still evolving, and might take more work to bring it at par with the capacity of centralised financial institutions (since they also took 100s of years to mature). Let’s look at each of these pros and cons of DeFi:

Advantages of DeFi

- Financial Inclusion: DeFi opens up financial services to the unbanked and underbanked populations who may not have access to traditional banking systems.

- Control: Users have full control over their assets and transactions, eliminating the need to trust a third party.

- Lower Costs: By cutting out intermediaries, DeFi often reduces transaction fees and provides better interest rates for lenders and borrowers.

- Innovation: DeFi is constantly evolving, with new products and services being developed regularly. This creates a dynamic and competitive market that benefits users.

Risks Associated with of DeFi

- Smart Contract Risks: Smart contracts are code, and code can have bugs. If a vulnerability is exploited, users can lose their assets.

- Regulatory Uncertainty: DeFi operates in a regulatory gray area, and future regulations could impact the ecosystem. This is a major reason for lesser adoption among masses.

- Volatility: Cryptocurrencies are highly volatile, and while DeFi offers opportunities for high returns, it also comes with significant risks.

- Scams and Hacks: DeFi is still a relatively new space, and it has been targeted by scammers and hackers. It’s essential to do thorough research before investing in any DeFi project.

- Education: “What is DeFi?” is a difficult question to answer. Since the user of a decentralised app has more control over their digital assets and currency, they need more education and understanding on how to use them the right way and keep themselves safe. Unlike Centralised Finance, where there are many guardrails and it is easier to use.

How does DeFi Work?

Decentralized finance, or DeFi, operates through specialized software known as dApps (decentralized applications). These dApps predominantly run on the Ethereum blockchain, offering a range of financial services without the need for traditional banking infrastructure. Unlike conventional banks, DeFi platforms don’t require users to fill out applications or open accounts, making financial services more accessible and transparent.

Here’s how people are utilizing DeFi today:

- Lending: Users can lend their cryptocurrency and earn interest continuously, unlike traditional banking systems where interest is typically accrued monthly. This provides a more dynamic and potentially higher return on investment.

- Borrowing: DeFi platforms allow users to secure loans almost instantaneously without the need for credit checks or paperwork. This includes “flash loans,” a type of loan that must be borrowed and repaid within the same transaction, something traditional finance doesn’t offer.

- Trading: DeFi enables peer-to-peer trading of cryptocurrency assets. This means users can trade directly with each other, bypassing traditional brokers and exchanges, which often come with fees and delays.

- Savings: DeFi provides alternatives to traditional savings accounts, allowing users to deposit their crypto and earn higher interest rates compared to conventional banks. These decentralized savings options are often more attractive for those looking to maximize returns.

- Derivatives: Similar to stock options or futures in traditional finance, DeFi platforms offer derivatives, allowing users to speculate on the future prices of assets by taking long or short positions.

This decentralized ecosystem offers a more open and accessible financial system, allowing anyone with internet access to participate in lending, borrowing, trading, and investing, often with fewer barriers and more flexibility than traditional financial institutions. However, it’s important to approach DeFi with caution, as the space can be volatile and is subject to fewer regulations.

Learn to Build DeFi Apps on Metaschool

If DeFi use case of Web3 excites you, then you can learn to build DeFi applications for free on Metaschool. You can also follow quick guides on building on DeFi on Metaschool such as How to create a flash loan using Aave and more. Here are some official guided courses we’ve curated from Metaschool that you can enrol in to learn DeFi:

- Build a Token Dex dApp On the Sui Blockchain: Enrol for free and learn how to create your own decentralized exchange (DeX) using Move on Sui, the native language of the Sui blockchain. The course will guide you on setting up the development environment and building the DEX from scratch. Once ready, your DEX app will support swapping of ETH and USDC tokens with each other. After building the DEX, you will learn to deploy the dApp on Sui Testnet. Lastly, you will integrate the frontend, run it, and interact with the dApp.

- Build a Lending dApp on the Core blockchain: This is a great course to learn Bitcoin-centric Decentralized Finance on the Core blockchain. Given that Bitcoin is the most popular and trusted cryptocurrency and Blockchain, a DeFi app on Bitcoin will have a good reception in web3 world. This course teaches you to to build a fully functional lending dApp while gaining proficiency in Solidity. The course covers Core programs for developers, BTCfi, smart contract creation, frontend integration, and deployment on the Core testnet, providing a guided and detailed understanding of development on the Core blockchain.

- Build the future of finance on MANTRA Chain: This Mantra Chain course will guide you through the exciting world of real-world assets (RWAs) and their tokenization on the blockchain. From the innovative Cosmos ecosystem to MANTRA Chain’s unique vision and architecture, this course helps you become an expert in MANTRA Ecosystem. Discover how MANTRA Chain is revolutionizing real-world asset tokenization and learn the tools to participate in this new era of onchain finance.

Conclusion

DeFi represents a bold step towards a more open and inclusive financial system that is not controlled by centralised entities. By removing intermediaries and providing users with more control over their assets, DeFi has the potential to revolutionize finance. However, as with any web3 technology usecase, it’s essential to approach DeFi with caution, understanding both its benefits and risks.

Whether you’re looking to earn interest on your crypto assets, trade without relying on centralized exchanges, or simply explore the possibilities of a decentralized world, DeFi offers a wide range of opportunities. The future of finance is decentralized, and DeFi is leading the way.

FAQs

What is a DeFi in crypto?

DeFi, short for Decentralized Finance, refers to a financial ecosystem built on blockchain technology that operates without the need for traditional financial intermediaries like banks or brokers. Instead of relying on centralized institutions, DeFi uses smart contracts—self-executing contracts with the terms of the agreement directly written into code—to facilitate financial transactions.

Is DeFi safe?

While DeFi platforms are transparent and accessible, they are not 100% safe and must be used with caution. Risks include smart contract bugs, platform hacks, market volatility, and the lack of regulatory protections. Users should conduct thorough research, use secure wallets, and avoid overexposing their assets to minimize potential losses.

What is the best DeFi platform?

There isn’t one “best” DeFi platform, as the choice of DeFi platform depends on your personal usecase. Some popular DeFi platforms include Uniswap for decentralized trading, Aave for lending and borrowing, and Compound for earning interest on crypto deposits. Each platform is good in different areas, so it’s important to choose one that aligns with your goals and always do through market research on available DeFi platform for your own needs.

What is a DeFi Wallet?

A DeFi Wallet is a digital wallet that allows users to securely store and manage their cryptocurrencies while interacting with decentralized finance Apps. There are both custodial and non-custodial wallets (meaning users have full control over their private keys and funds). Some popular DeFi wallets are MetaMask, Trust Wallet, and Coinbase Wallet.